The screaming about the headline inflation rate derived from today’s CPI of 3% are totally missing the point. Consumer price inflation is not controllable by the central bank. It is a mere partial view of inflation, for consumers only and not well calculated, as it persistently misses quality or hedonic changes in purchasing patterns.

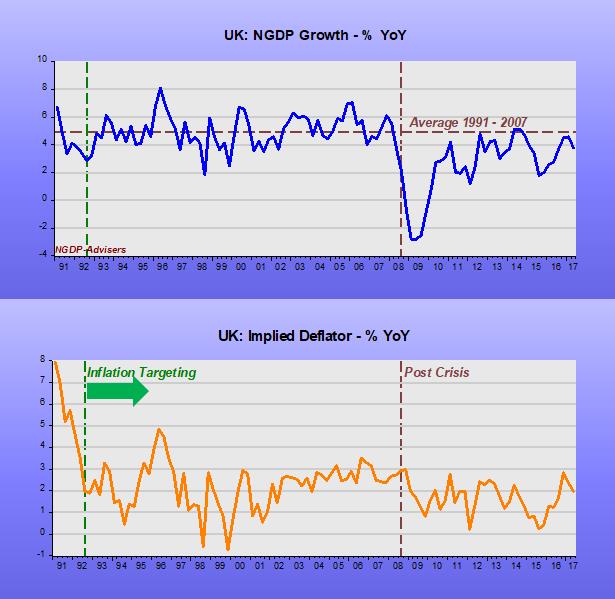

Central banks can only control Aggregate Demand, the sum of real growth and inflation, or nominal growth. With so many prices indexed to CPI and some insanely still indexed to the old, discredited, RPI (that runs around 0.5%-1.0% higher than the CPI) damaging rigidities and imbalances in the UK economy are inevitable.

While recent nominal growth has been decelerating, it could reasonably be expected to decelerate further as the uncertainty over the actual Brexit rises. Mark Carney pointed this out today and GBP rightly fell. The recovery in GBP recently has been very concerning for us as it indicated tightening monetary policy at the wrong time. Even better news is that the two new members of the MPC agree with Carney, and the foolish hawks now seem less powerful.

Amongst the hawks we know just how idiotic Ian McCafferty has been in the past, consistently calling for rate hikes whatever the economic reality, always fearing inflation around the corner. He´s the Esther George analog at the BoE.

Recent appointee Michael Saunders is a huge disappointment given his supposedly market background. One more example of finance people misunderstanding monetary policy.

Most disappointing of all has been the hawkish stance of the new’ish chief Economist Andy Haldane. Even if in September he did not vote for a rate rise, he caused massive anxiety when he broke with his boss in the 5-3 vote for no change in June. He is a Bank of England man and boy, has often showed some independent thinking about bank regulation and suchlike, but he seems a very old school believer in Phillips Curve nonsense when it comes to monetary policy.

At one point, Andy Haldane was considered a candidate to replace Mark Carney as Governor, not anymore. WeI hope that the former chief Economist of the Treasury and new MPC member, Dave Ramsden, will get the job. He is a government insider and knows the value of nominal growth. The formal answers to Parliament on his appointment to the MPC show a very healthy regard for the central importance of aggregate demand.