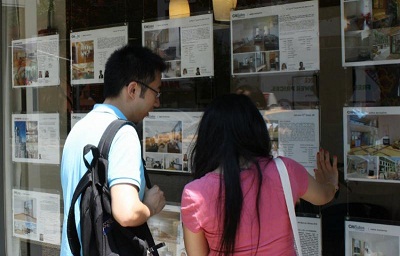

By Tania Suárez, in Madrid | In Spain, the fall in the housing prices is intensifying and that is a reason to rejoice. Last July, the average housing price fell 11.2%, but the granting of mortgages went down by 21% in the first half of the year. It is obvious that the owners may not feel comfortable with these decreases, but the truth is that as housing prices keep on going down, the end of the crisis in Spain comes nearer.

By Tania Suárez, in Madrid | In Spain, the fall in the housing prices is intensifying and that is a reason to rejoice. Last July, the average housing price fell 11.2%, but the granting of mortgages went down by 21% in the first half of the year. It is obvious that the owners may not feel comfortable with these decreases, but the truth is that as housing prices keep on going down, the end of the crisis in Spain comes nearer.

As experts at Nordkapp point out, we cannot forget that the end of a crisis doesn’t reach its climax until the reason why it began disappears. In Spain, that reason was the credit bubble: it raised housing prices, which led to an excess in real estate transactions. In order to make capital flows going back to the real estate sector and thus to kick-start the Spanish economy, it is necessary a drop in the housing prices. Low prices attract new capital, and the input of new capital leads to economic growth.

“Despite that we think that housing prices in Spain will fall even further, we are happy about the beginning of this downtrend: it is a good sign,” Nordkapp explained.

As a matter of fact, job insecurity coupled with this fall in housing prices will cause a lower mortgage credit demand, which in turn will result in a really strong drop of the prices in the future. Furthermore, the recent measures of the Spanish government and the possibility of a bailout, also point to that conclusion.

Be the first to comment on "As housing prices keep on going down, the end of the crisis in Spain is nearer"