Morgan Stanley | An improving cycle as well as prolonged stimulus support and a return to dividends is what justifies our positive outlook for the European banking sector.

Earnings momentum has increased and comments on dividends are encouraging: although in the short term we continue to see payouts of 15-25% and dividend yields of no more than 2%, we expect that in September the limitations on dividend payments will be lifted.

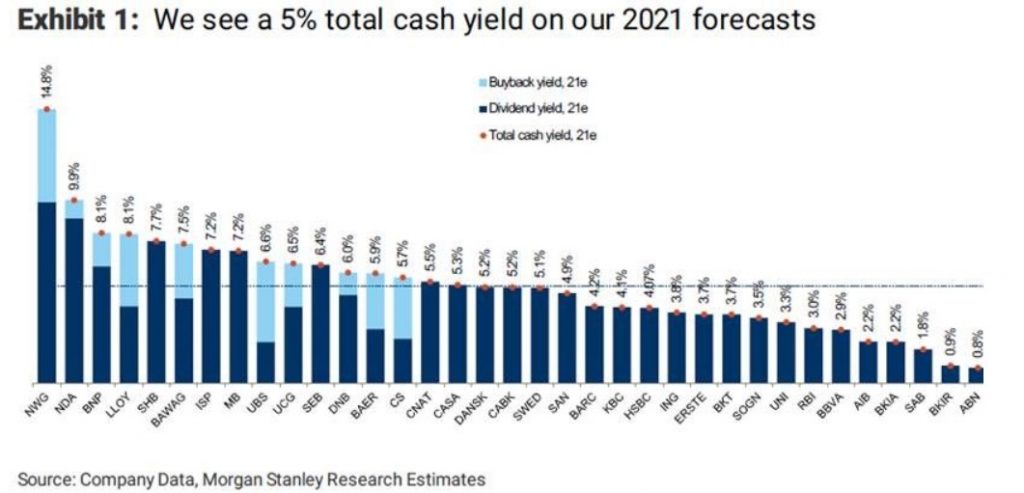

On the other hand, we estimate an average cash yield of 5% (including dividend yields and buybacks) on 2021 earnings. We recommend special attention to Natwest Group, ING, BNP, KBC, Bawag and Credit Agricole, where we expect higher payouts in the form of buybacks or special dividends.

As for Spanish banks, BBVA announced a 10% buyback after completing the sale of its US subsidiary, with a payout of 35-40% by 2021. Santander has said it intends to return to 40-50% cash payouts when regulators allow. Caixabank will hold a dividend per share of €0.0268 subject to a 15% payout required by the ECB. Bankinter’s DPS will reach €0.10. Unicaja and Sabadell have not proposed dividends for 2020.