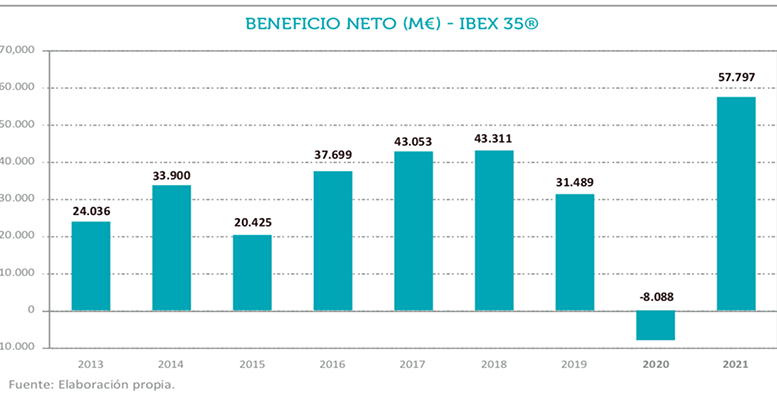

BME | Revenues of large listed companies rebounded by 17.4% in 2021 from 2020 to €477.778 billion euros. The figure was still 8.3% lower than that achieved by IBEX 35 companies in 2019. A positive indicator for this group of leading companies in Spain is that, with less revenue than before the pandemic, they have achieved the highest aggregate profit figure in their history. IBEX 35 companies generated close to €58 billion in net profits in 2021, showing a V-shaped recovery from pre-COVID levels. This amount is 83.5% above 2019 and 33.45% above 2018. EBITDA for the 2021 figure increased by 66.1% YoY. EBITDA is the profit derived from a company’s ordinary or usual business operations (earnings before interest, taxes, depreciation and amortisation).

The main reason why variations in turnover differ so much from those in net profits obtained by IBEX 35 companies is largely due to the decrease in asset impairment and the correction of provisions that had been imputed as a result of the pandemic. In this respect, the impairment and disposals of fixed assets of IBEX 35 companies fell from more than 40 billion euros to around 18 billion, -56.1%. Likewise, Spanish companies, especially those larger and with a greater fixed asset structure, enjoy high operating leverage, as can be seen in one of the attached graphs.

In the case of the IBEX Medium Cap, the second tier in size and liquidity of the companies included in the IBEX index range, the group closed 2021 with earnings of 3.736 billion euros, compared to 1.619 and 1.875 billion euros in the previous two years (+130.8% and +99.2%, respectively). The turnover of these selected companies grew by 7.9% in the year. The major contributors to growth in this selection of companies were companies related to industry and construction and to energy.

Similar results are repeated for all non-financial and unlisted companies in the Spanish economy according to data from the Bank of Spain’s Central Balance Sheet Data Office (CBQ). According to this sample source, the profits of Spanish non-financial firms rebounded by 141.3% in 2021 with respect to 2020, although the figure achieved is 51.7% lower than that recorded in 2019, before the outbreak of the pandemic.