Claudia Canals and Oriol Carreras Baquer (Caixabank)| Having analysed in the previous articles the digital needs of our economy and the policies proposed in order to meet those needs, in this article we address the impact that NGEU will represent in quantitative terms for the digital transformation. Before embarking on the numerical exercise, however, it is essential to understand the importance of digital technologies as well as the characteristics that usually define them.

Digital technologies: the new «currents» of change, the new forms of «electricity»

Technologies with the capacity to dramatically change societies are known as General Purpose Technologies (GPTs). Electricity is a clear example of such revolutionary technologies. Digital technologies (especially AI) are destined to join the ranks too.

One characteristic that usually defines GPTs in their early stages is the delay in showing a real positive impact on productivity. The main reason for this delay is the high cost of implementation. For instance, although the first power plants in the US date back to 1881, in 1900 less than 5% of US factories had adapted to electricity. After all, for the first few years, the price of these technologies is often very high. The cost of adopting new technologies also tends to be very high: significant investments are needed to acquire new technology, as well as to adapt production processes to the new technology in order to make it fully efficient. In the digital age, beyond investing in hardware, software and R&D, investment in organisational capital is essential – particularly in human capital, productive processes, organisational practices and even the business model.

When this «implementation delay» is overcome is when the three characteristics which GPTs tend to have in common, and which give them their enormous capacity to foster change, are manifested: (i) omnipresence, (ii) the potential for constant technical improvements and (iii) complementarity with other innovations. After all, omnipresence is usually achieved when the installation and adaptation costs are sufficiently low. On the other hand, complementarities tend to manifest themselves when there is sufficient critical mass.

It is precisely these characteristics which define GPTs and give them this potential for change that also make impact analyses difficult. In fact, the effects of AI on productivity is an issue that the economic literature has not yet clarified, although its potential is perceived to be very high. Looking back, consider the deployment of the use of electricity. In the US between 1890 and 1914, when electricity usage was still low (in 1913 it accounted for only 36% of the total energy used), average labour productivity growth was 1.4% per year. In contrast, between 1915 and 1953, when electricity usage expanded very rapidly (in 1953 electricity accounted for 85% of the total energy used), average growth more than doubled (up to 3.5%).

The growing role of investment in intangible assets

The development and implementation of digital technologies, and of AI in particular, requires significant investment in intangible assets. Examples of such assets include software, databases, innovation (through R&D) and organisational capital. Unlike the more traditional form of capital (tangible assets), which largely consists of machines and buildings, intangibles lack a physical component.

In the case of digital investment, as Anderton and co-authors analyse, between one-third and two-thirds tends to consist of investment in intangibles. Thus, beyond requiring good telecommunications infrastructure (physical, or tangible, capital), AI also requires many other intangible assets in order for its benefits to fully flourish. Software and the use of big data are a given, since they are the main inputs for their use, but it also requires changes in companies’ organisational models and substantial investments in human capital.

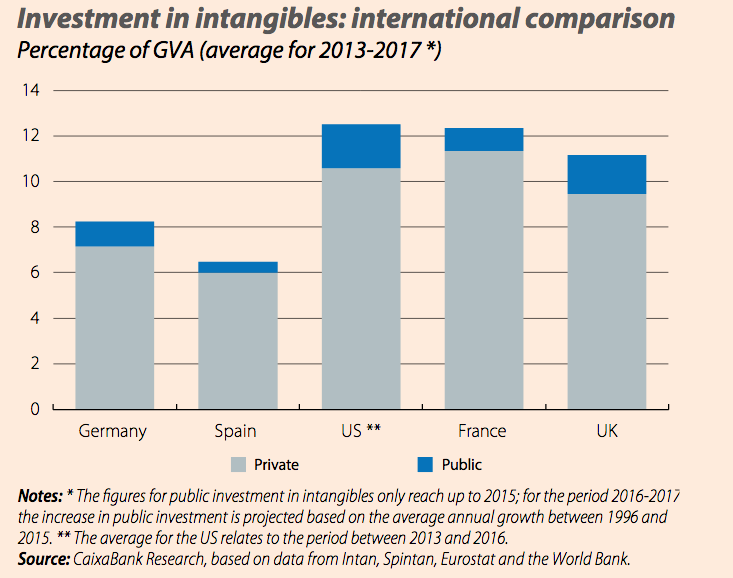

Given the importance of intangibles in the digital age, where does investment in intangibles in Spain stand and how does it compare with other major advanced economies? In the chart we show the investment in intangible assets (as a percentage of GVA) of the major European countries and the US. We can see how the US leads the way in investment in intangibles, at just over 12% of GDP, although France and the UK are close behind. In contrast, Germany and Spain are lagging far behind, with investment of 8% and 6.5%, respectively. We can also see how much of the investment in intangibles is private, although here there are also differences from country to country: in the US, the UK and Germany, public investment in intangibles represents around 15% of the total, whilst in Spain and France it stands at around 8%.

Where will NGEU place us?

One of the cornerstones of the NGEU European economic package is the digital transformation. In this regard, and given the importance of investment in intangibles for boosting the digital transition, we wonder what impact NGEU will have on this type of investment. To answer this question, we proceed in two phases. First, we estimate the average increase in the relative weight of investment in intangibles as a proportion of GDP in Spain in recent years: between 1995 and 2017, the period for which we have data, the relative weight of investment in intangibles grew on average by 0.11 pps per year. This is a higher rate than that registered by the US over the same period, at 0.08 pps per year, probably due to the North American economy being at a more mature phase in terms of digitalisation. We then measure the impact that NGEU will have on investment in intangibles, considering in the calculation the carry-over effect that this programme could have on private investment.

As set out in the previous article of this same Dossier, the investment in digitalisation envisaged in the six action plans announced by the government for the period 2021-2023 amounts to 16.25 billion euros, of which 15.4 billion will be financed by NGEU. Of this amount, we must exclude 4.7 billion destined for the Connectivity Plan, the 5G Plan and other investments in ICT equipment, since infrastructure investment, although crucial for the digitalisation of the economy, does not count as investment in intangibles. Thus, in annual terms, NGEU represents a direct investment in intangible assets of almost 3.6 billion annually over the next three years, equivalent to 0.29% of GDP per year.

This boost to public investment is also expected to attract private investment in intangibles. More specifically, the government expects that, during the three-year period in which these investments are made under NGEU, some 26 billion euros will be attracted in private investment in intangibles. This knock-on effect would add between 0.2% and 0.7% of GDP in additional investment in intangibles to the impact mentioned above, depending on whether all of the private investment anticipated by the government is finally attracted or whether a more conservative estimate of one quarter of the anticipated amount is applied. Therefore, the sum of the direct impact plus the knock-on effect would increase the relative weight of investment in intangibles as a proportion of GDP by between 0.5 and 1.0 pp. This is a significant figure which, according to our estimates for the implementation of the budgeted funds, will enable us to achieve levels of investment in intangibles in 2022 which, in the absence of NGEU, would not have been achieved until at least 2026.