Pablo Fernández (IESE) | The average return of mutual funds in Spain over the last 15 years (1.91%) was lower than the investment in 15-year Spanish government bonds (4%). The average return of the Ibex 35 index was 1.35%, that of the EuroStoxx 50 4.2% and that of the S&P 500 was 10.7%.

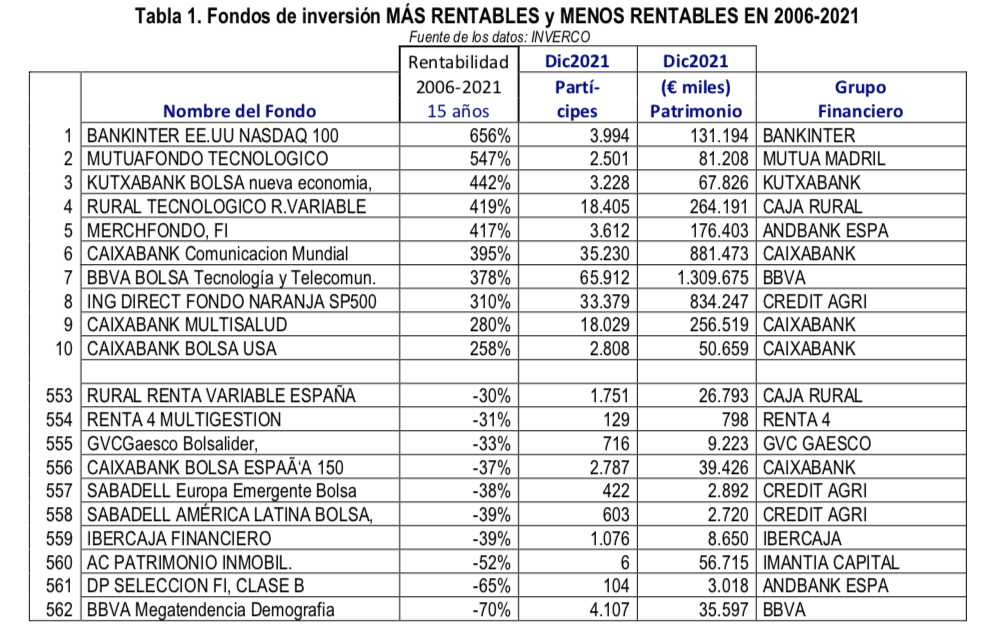

64 funds out of 562 Spanish funds with a 15-year history outperformed 15-year government bonds, 314 outperformed the Ibex 35, and 8 funds outperformed the S&P 500.

68 funds had negative returns. The most profitable fund provided a total return of 656% and the least profitable fund -70% over the last 15 years.

In 2019 there were 631 Spanish funds with 15 years of history, in 2020 there were 614, and in 2021 there were only 562.

The study also shows the results of an experiment: 248 schoolchildren achieved better average returns than equity mutual funds in 2002-2012. Of the 248, 72 schoolchildren outperformed all funds. The average return of the schoolchildren was 105% and that of the funds 71%.

Read More: