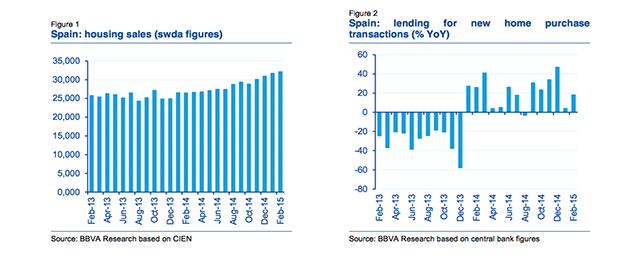

In February, the General Council of Notaries registered home sales of 26,562. After adjusting for the typical seasonality of the month, we are seeing a slowdown in sales growth relative to recent months. In February, transactions were up 1.4% compared to January. (Figure 1).

The demand fundamentals continue to show growth, with employment still on the rise and unemployment falling once again. The figures for those registered with the Social Security department in March, as well as those included in the first quarter Labour Force Survey (EPA), again showed progress in the labour market. This, together with further gains made in restoring consumer confidence in March, means that demand is on a sounder footing than it was a few months ago.

The mortgage market is picking up

The improved situation for demand, combined with a fall in the cost of borrowing, is boosting mortgage market activity. The volume of credit for new home purchases rose again in February, as illustrated in Figure 2. This also translates into an increase in the number of mortgages for home buying, which amounted to 19% YoY in February.

Interest rates continue to respond to monetary policy, as is reflected in the further fall in the 12-month Euribor for March, which closed at 0.21% or 0.04pp down on the previous month. The mortgage rate associated with new transactions is therefore expected to remain on a downward path, having fallen to 2.53% in February, which is 0.05pp below the January figure.

Construction activity continues its recovery

The figures on construction activity tell us that recovery in the residential segment is forging ahead. Firstly, significant progress is still being made in the labour market, with employment in the sector posting an above-average performance in March, growing 0.8% compared to the previous month (Figure 3). Furthermore, unemployment in the sector also declined more than average. This showing was also endorsed by the Labour Force Survey data, which revealed 12.6% growth YoY for construction employment in the first quarter of the year.

Cement consumption clocked up another month of growth and the volumes in March rose to a YoY rate of 8.2%. Along the same lines, the residential construction climate indicator ticked up again in March, with order levels up and an improved employment trend, which meant increases in the output level and the number of days of guaranteed work.

All in all, in February the number of permits signed for new housing construction (4,203 units) again surprised on the upside, following the major rise registered for the previous month. As a result, new home starts for the first two months of the year posted a YoY increase of 48%.

Land market prospects are turning positive

The improvement in the demand for residential assets is also feeding through into the urban land market. In 2014, urban land sales totalled 15,900 transactions (Figure 4), a rise of 9.2% Y0Y, according to figures from the Ministry of Public Works. This increased demand for plots was basicaly found amongst populations of over 10,000 inhabitants, where sales grew 26.3% YoY. In general, land markets are showing more activity in those regions which are more tourism-oriented, whilst they are at a relative standstill in more inland regions.

After the 45% correction from their highs, urban land prices have begun to stabilise, so the increased demand has been reflected in a slight rise in land prices, which increased by 5.2% in 2014 nationwide. From a regional standpoint, the higher land prices are concentrated in certain markets like Andalusia, Madrid, Catalonia, Galicia and the Basque Country. In other regions, prices are still adjusting.

Be the first to comment on "Spanish housing sector recovery continues to progress"