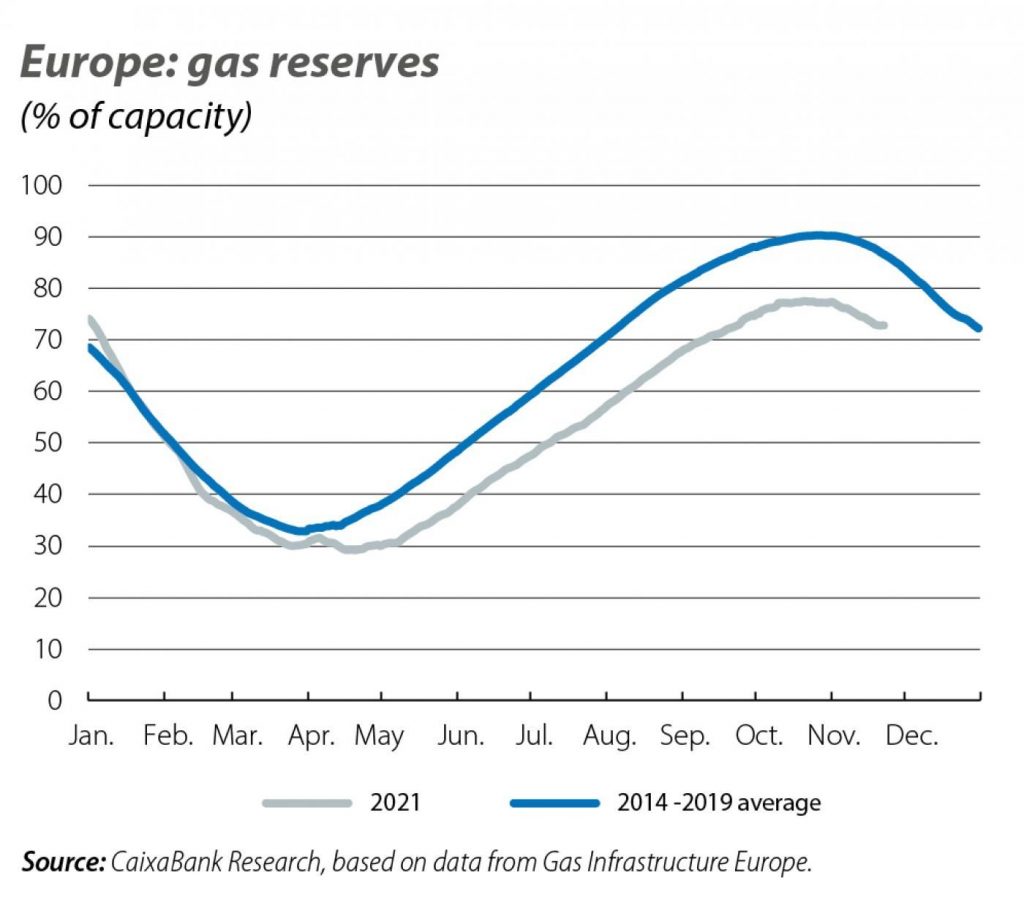

Oriol Carreras Baquer & Eduard LLorens i Jimeno (CaixaBank) | There are a number of factors behind the rise in the price of electricity and, although they are not necessarily related to each other, they have coincided to form an explosive cocktail. The determining factor has been the increase in the price of natural gas. It should be recalled that natural gas, besides its use in heating our homes, is also used to generate electricity. The increase in the price of natural gas, in turn, has largely been due to the relatively low reserves held on the European continent to cope with this winter (see first chart).

Once again, there are several reasons why these reserves are low. Firstly, there have been geopolitical problems with countries that supply gas: Russia, on the one hand, and Algeria and Morocco, on the other. Secondly, supply-side disruptions, such as those experienced in Texas at the beginning of the year or those related to the gradual closure of the Groningen extraction plant in the Netherlands, have also contributed to the shortages. Thirdly, China’s economy is undergoing a transition from a coal-based economy to a more natural-gas-based one, as the latter is a cleaner energy source, and this process has led to the emergence of a huge competitor in the demand for liquefied natural gas. This has had repercussions for Europe, as importing liquefied natural gas has traditionally been a mechanism for accommodating peaks in demand, only on this occasion there has been much greater competition. Finally, these factors have been compounded by the gradual but steady increase in the price of carbon emission allowances, as European decarbonisation policies have become stricter.

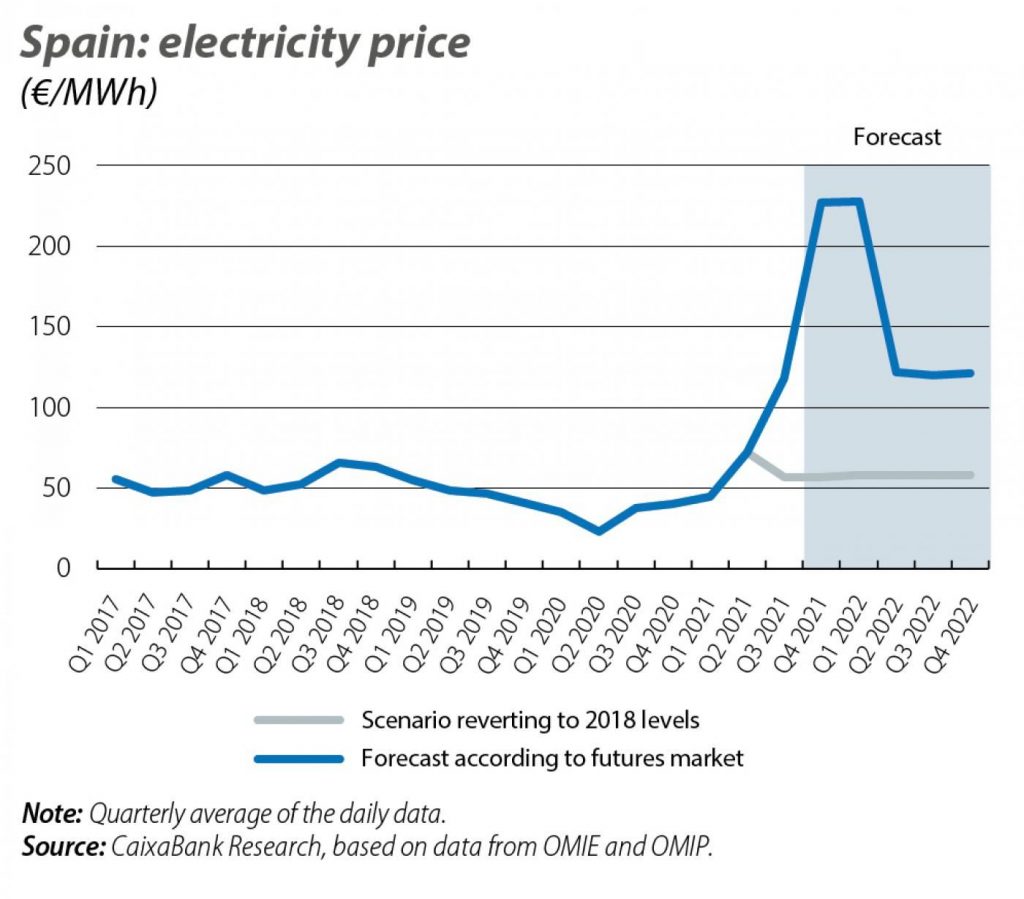

All these elements have contributed to a sharp surge in the price of electricity, and this trend looks set to persist throughout the winter. Nevertheless, once temperatures begin to rise in the spring, demand for natural gas will moderate and the pressure on electricity prices should also ease. This moderation is unlikely to bring about a return to the electricity prices of 2018 or 2019. We believe that prices will stabilise slightly higher, as there are structural factors that will keep the price of natural gas above pre-crisis levels, such as the increased demand from China and the higher emissions prices.

What will be the economic impact of the increasein electricity prices?

To estimate the impact that the increase in electricity prices will have on economic activity, we take the price forecast according to the futures market (see second chart). As can be seen, according to this forecast prices will remain in line with current levels through to Q1 2022 and will normalise beginning in Q2 2022, but still remain higher than in 2019, as mentioned above.

An energy price shock has a major impact on household spending. In particular, if the price of electricity behaves as expected by the futures markets, we estimate that household spending in 2022 could be 0.6% lower than it would have been if the price had returned to 2018 levels as early as Q3 2021. Electricity accounts for a relatively small portion of the average household’s outgoings (around 3.5%), but the price increase is so large that the impact ends up becoming significant. Moreover, this estimate only takes into account the direct impact of the rise in the price of electricity on household expenditure, so the final impact on the economy as a whole would be greater.

If we consider the impact of the electricity price shock not only on household consumption, but also on investment (companies may be forced to postpone their investment decisions due to rising production costs), as well as the second-round effects that all of this would have on economic activity, then the impact is clearly greater.Specifically, GDP growth in 2021 and 2022 would be 0.1 and 0.3 pps lower, respectively (see third chart). And this would be the result of both lower growth in consumption and lower investment growth. Inflation, meanwhile, would rise significantly, by 2.1 and 1.1 pps in 2021 and 2022, respectively.