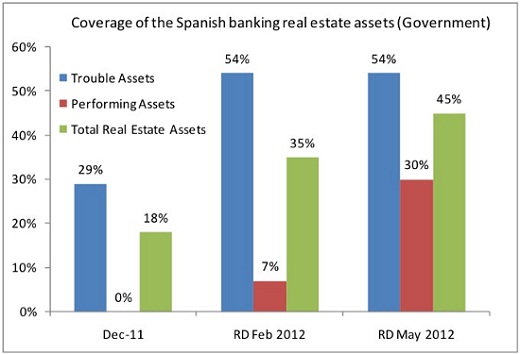

Performing real estate assets in Spanish banks must now be provisioned at 30 percent of its book value, which will raise the average coverage ratio for all real estate assets to 45 percent. Then, troubled and toxic real estate assets will be transferred to an asset management company (sociedad de gestión de Activos) and the rest of the portfolio will be independently audited.

The picture of the situation within the banking system in Spain should in the end look something like this graph sent in by Bankia Bolsa analysts.

Be the first to comment on "Tuesday’s chart: real estate asset coverage in Spain’s banks"