Javier Garcia-Arenas (CaixaBank Research ) | The pension reform currently being prepared in Spain is a hot and pressing issue. After all, the structural deficit of the Social Security system (around 18 billion euros) and the need to ensure the system’s long-term sustainability in the face of demographic ageing are inescapable challenges for our economy. In this context, the minister for Inclusion, Social Security and Migration, José Luis Escrivá, has announced that he intends to boost workplace pension schemes (also known as company pension) in order to encourage long-term saving, as well as indicating that the British model could serve as a good example to follow.

What does this model involve and to what extent is it exportable to Spain? Since 2012, British companies have had to automatically enrol their employees in a company pension scheme (provided they meet certain conditions: a salary of over 10,000 pounds, aged over 22, etc.), although workers can voluntarily opt out within one month. It is therefore intended to give economic players the necessary «push» to start saving and not to leave it for later. In addition, minimum annual contributions are required, representing 8% of the worker’s salary (before April 2019 this figure was 5%, and since 2012 it has been gradually increasing up to 8%). These contributions are split as follows: a contribution of 3% is made by the company and one of 5% by the employee (although in general their contribution is effectively 4%, thanks to a personal income tax deduction).

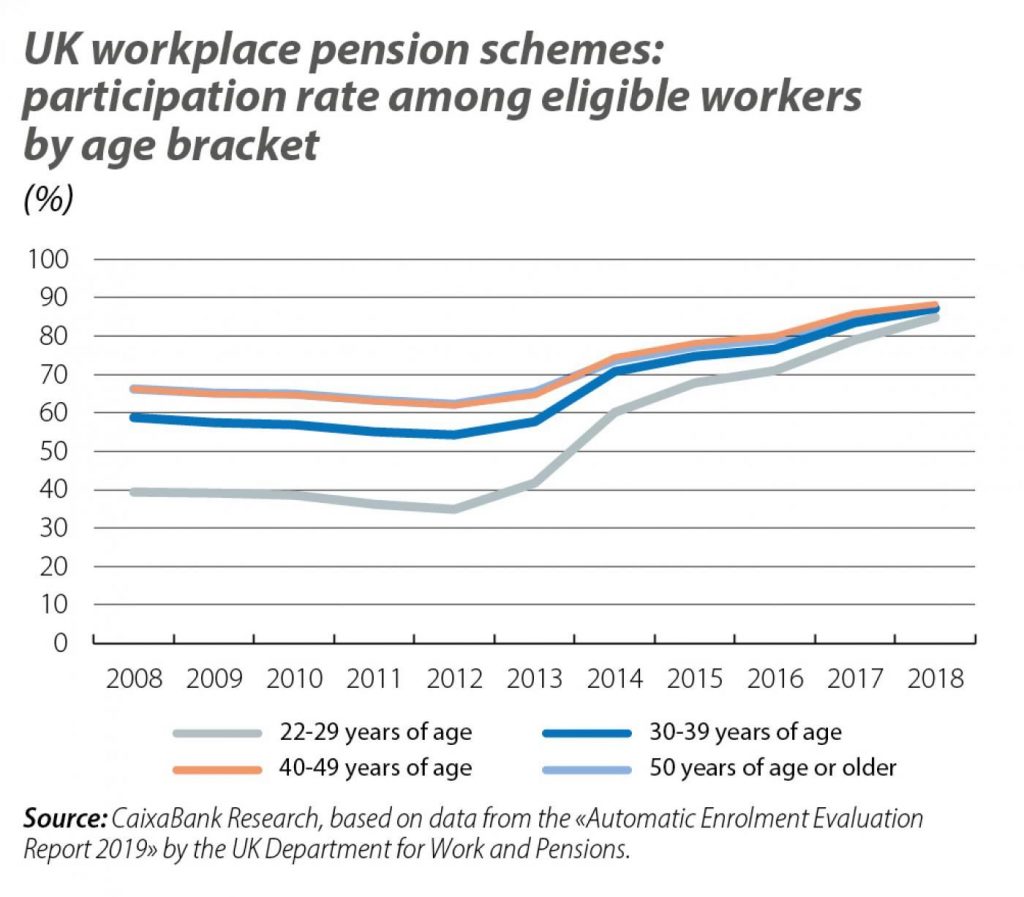

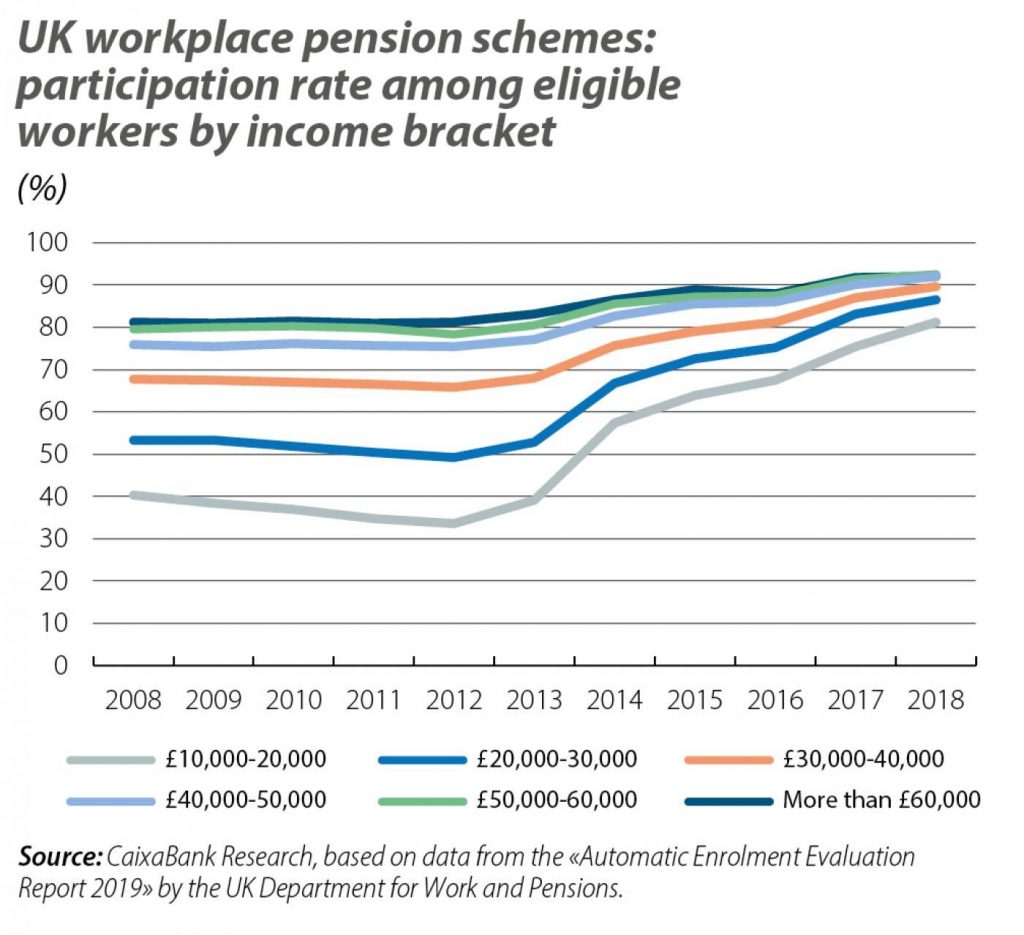

For the time being, workplace pension schemes appear to be achieving their goal of getting more people to save for retirement. Specifically, in 2018, 87% of the 21.5 million British workers eligible for these company 30 years of age, a group for which saving is particularly beneficial in the long term but which must also be offered attractive incentives in order to do so. Specifically, the participation rate among workers aged between 22 and 29 who are eligible for company schemes (almost 700,000 in 2018) rose from 35% in 2012 to 85% in 2018. On the other hand, the system has also served to encourage saving among those on low incomes: the participation rate among British workers with an income of between 10,000 and 20,000 pounds who are eligible for company schemes (more than 1 million workers in 2018) rose from 34% in 2012 to 81% in 2018 (see second chart).

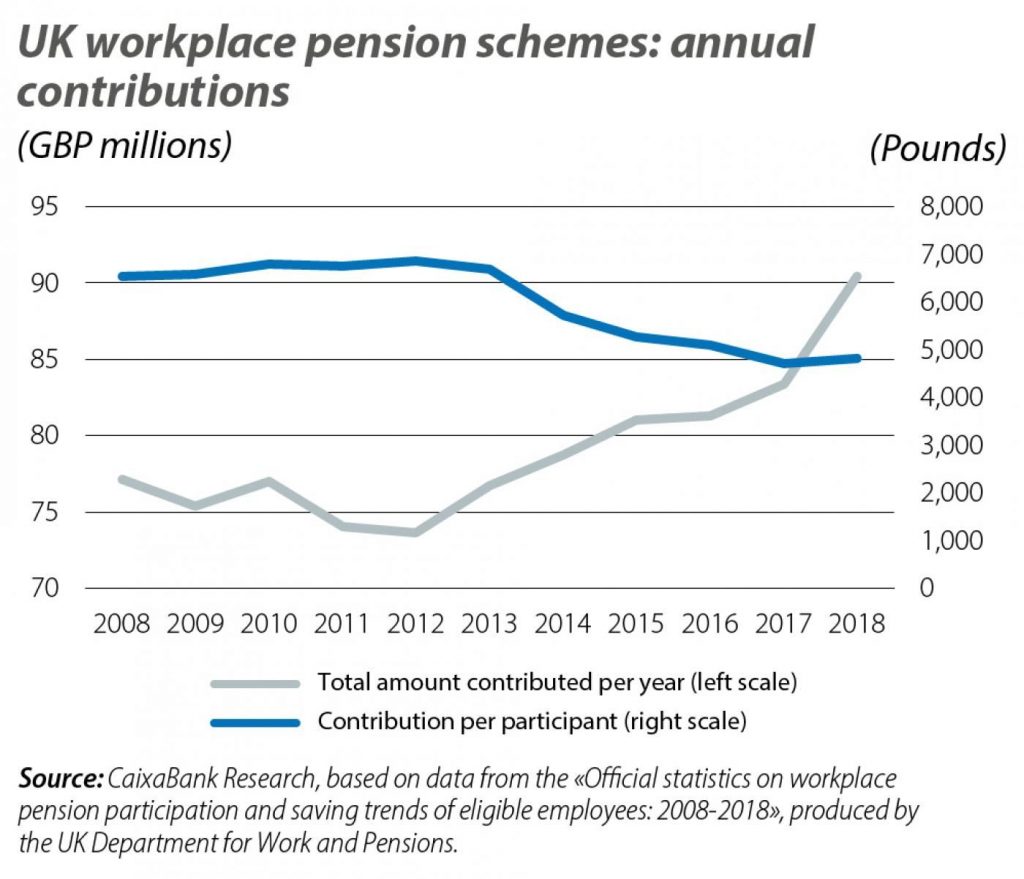

As for the volume of contributions, the total amount contributed to these plans in 2018 came to 90 billion pounds (4.2% of UK GDP), representing an average contribution per participant of 4,800 pounds. As a point of reference, the annual public pension received by a British employee who retires after 35 years of making social security contributions is around 9,000 pounds a year. However, it is proving difficult to get workers to make substantial contributions to these plans: 64% of these savings were contributions from companies, compared to 26% from employees (and only 27% of private sector workers contribute more than 5% of their salary that is eligible for a pension).

To what extent is the British model of private workplace pensions exportable to Spain? Such comparisons are always difficult, given the institutional differences and particularities of the two pension systems. However, the introduction of mechanisms that complement the public pension system could be of great help in the face of the foreseeable decline in the public pension replacement rate – i.e. the ratio between the average pension and the average wage. This rate currently stands at 73%, a figure that will be difficult to sustain in the face of demographic pressures (the average replacement rate of public pensions across OECD countries is 40%).

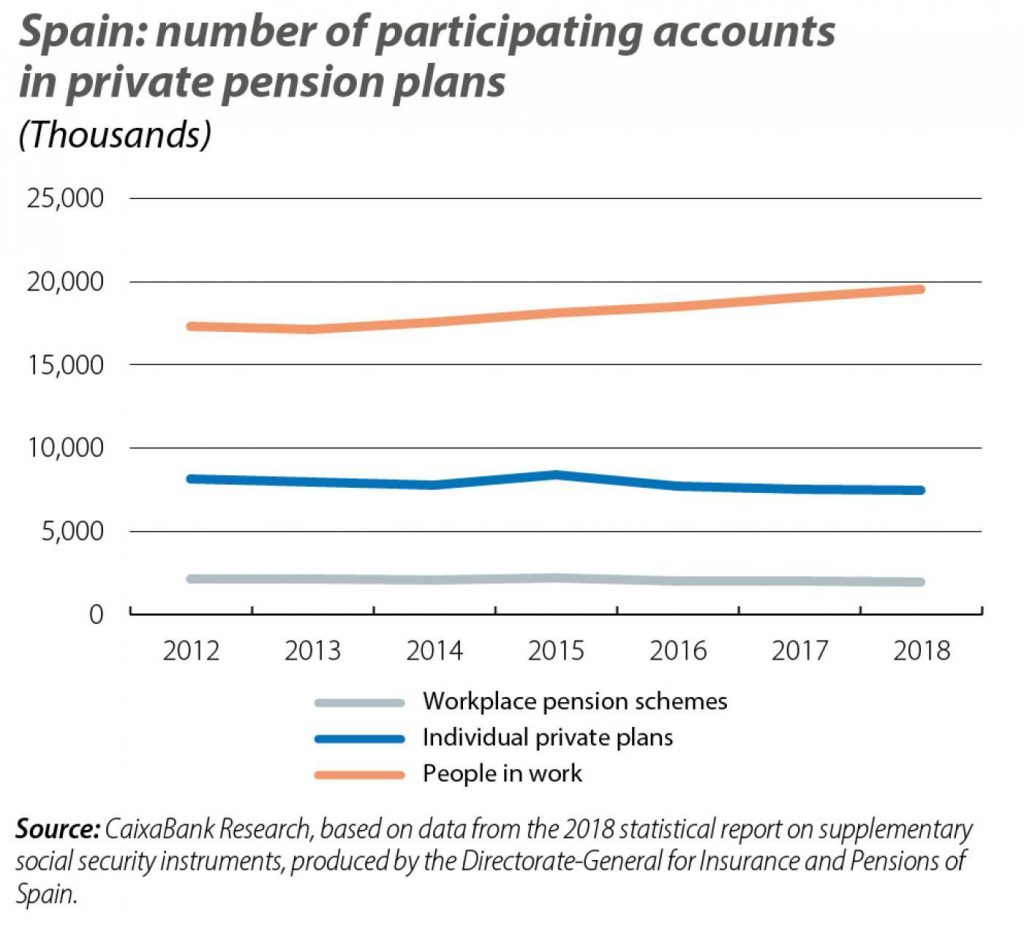

Workplace pension plans are virtually testimonial in Spain, so an automatic enrolment model similar to the British one could significantly boost private saving. As a point of reference, only 1 in 10 workers in Spain had such a plan in 2018, and 66% of those workers made no contributions. As for individual pension plans, there are some 7.5 million of them – also a low figure when compared to the number of workers (see fourth chart).

Nevertheless, implementing such a system in Spain would come with significant challenges. One such challenge is designing the system so that it does not significantly increase the labour cost to firms, while also making it sufficiently attractive to workers (which will no doubt require tax deductions). Another lies in how to ensure it reaches as many people as possible and improves inclusiveness: in the United Kingdom, for instance, a gap exists in that there are over 8 million workers who are not eligible for these plans, including those on less than 10,000 pounds a year and the self-employed. One key difference with the United Kingdom is the fact that, even prior to the 2012 reform, these pension schemes were already somewhat widespread across the country. In part, it has to be said, this is because the replacement rate of public pensions in the UK has historically been much lower than in most advanced economies.