In the last few weeks, important decisions have been taken to advance towards a stronger and more resistant European Union (EU) in the long term. This is vital in order to resolve the sovereign debt crisis in the short term. In spite of these advances in the institutional sphere, huge uncertainty still hovers over Europe’s economy.

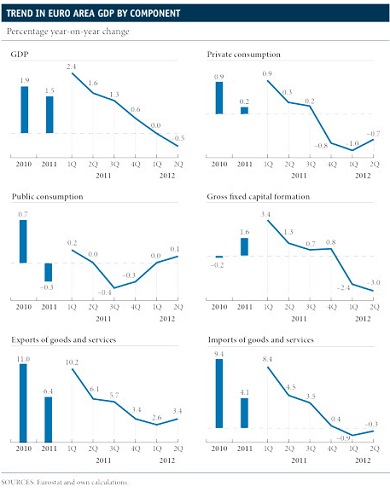

In fact, recently published statistics point to the euro area falling further into recession. After the stagnation in activity during the first three months of the year, real gross domestic product (GDP) fell by 0.2% in the second quarter of 2012, placing the year-on-year growth rate at -0.5%. This current weakness in activity is due to the fragility of domestic demand, whose contribution to GDP growth was -2.0 percentage points. On the other hand, exports maintained their positive contribution to growth at 1.6 percentage points, although this was not enough to offset the fall in domestic demand.

With regard to the different components of domestic demand, private consumption was down 0.2% quarter- on-quarter from April to June, the same decline as the one recorded in the first quarter. For the second half of the year, the outlook is that private consumption will continue to decline, as suggested by the fall in the confidence indicator for September.

ith regard to investment, this fell for the fifth consecutive month and stood at -3.0% year-on-year. Business investment is also expected to continue contracting over the coming quarters due to the high uncertainty and the restrictive conditions in some countries to access credit. Leading indicators for activity point along these lines.

The purchasing managers’ index (PMI) for September fell significantly with regard to the figure recorded the previous month, going from 46.3 points in August to 45.9. This is largely due to the sharp drop in the French PMI, falling from 48.0 points to 44.1.

The only component in domestic demand with positive growth was public consumption, up by 0.1%. This last figure was quite unexpected, especially if we take into account the fiscal consolidation that must be carried out by the different euro area countries. The boost provided by this component is therefore expected to be much more limited over the next few months as most governments should further contain public spending in order to meet their deficit targets.

An analysis of the breakdown in GDP for the second quarter of the four countries that, together, account for 70% of the euro area’s GDP, namely Germany, France, Italy and Spain, shows that weak domestic demand was the overall trend.

This was also the case in Germany, the only country to post a positive growth rate for this period. For their part, exports recorded a positive contribution. This confirms that the foreign sector was the motor for growth. However, over the next few months a slowdown is expected in the world economy, which might slow up exports. If this is the case, boosting domestic demand will be key to the economy’s recovery.

The economic outlook for the euro area is therefore clearly downward. In fact, according to the forecasts of the European Central Bank (ECB) for the euro area, the average annual growth in real GDP will be within a range of -0.6% to -0.2% in 2012. The forecasts are a little better for 2013, between -0.4% and 1.4%.

Be the first to comment on "Boosting domestic demand is key to the euro zone recovery"