UBS | A – shares have seen choppy trading since November amid Fed rate hike expectations, expansion of European QE, inclusion of the Rmb into the SDR basket, easing of curbs on prop trading at brokers and resumption of IPOs. The trailing PE of CSI 300/ChiNext has recovered to 13x/87x from 11x/65x in late August. Market participants have now turned their attention to what’s next for the market in 2016. Over the last three weeks, we met with over 60 institutional investors in places including Shanghai, Shenzhen, Hong Kong, Taiwan and Korea to discuss where A – shares could be headed next year.

Our view – neutral out look on CSI 300 index over next 12 months

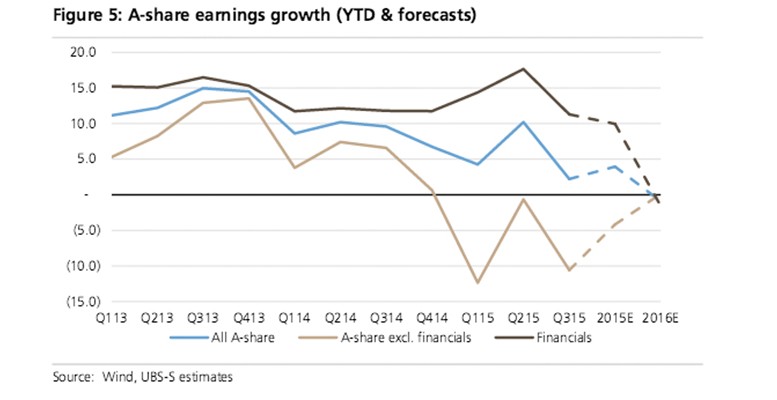

We expect A – share earnings to continue weakening next year, with aggregate earnings growth declining from 4% this year to – 1% in 2016, though valuations should receive some support from ample liquidity and reform expectations. Our end – 2016 CSI 300 target is 3,700. Despite the likelihood of a further slowdown in earnings growth, we think 2016 could continue to see a striking divergence in performance among sectors. Further structural shifts in China’s economy and targeted government support will likely fuel robust growth in certain new economy sectors.

Investors’ biggest areas of concern

Based on feedback from our latest trip, the top areas of concern for investors include: 1) A – shares − value trap or growth bubble?; 2) Rmb depreciation; 3) removal of market support measures; 4) bubbly conditions in the bond market; 5) state sector reform; and 6) the potential market impact of the upcoming Shenzhen – Hong Kong Stock Connect and registration – based IPO system. In the A – share market, domestic investors generally care more about growth prospects and are willing to pay a hefty premium for growth potential. They are also inclined to favour sectors that are explicit targets of policy support. Overseas investors, by contrast, ten d to prefer mid/large – cap names with high earnings visibility and reasonable valuations.

We prefer new economy sectors benefitting from structural shifts and policies

Reiterating the views in our 2016 Outlook , we like service and consumer discretionary sectors that benefit from shifting consumption dynamics (such as insurance, healthcare, entertainment, tourism) and sectors expected to enjoy policy support (such as energy conservation, environmenta l protection, high – end manufacturing). Top picks: Ping An, Robam Appliances, Semir Garment, Shanghai Int’l Airport, Hengrui Medicine, Jiangzhong Pharma, Huayi Brothers, CYTS, Gree, SAIC, Yutong Bus and Sanan Opto.