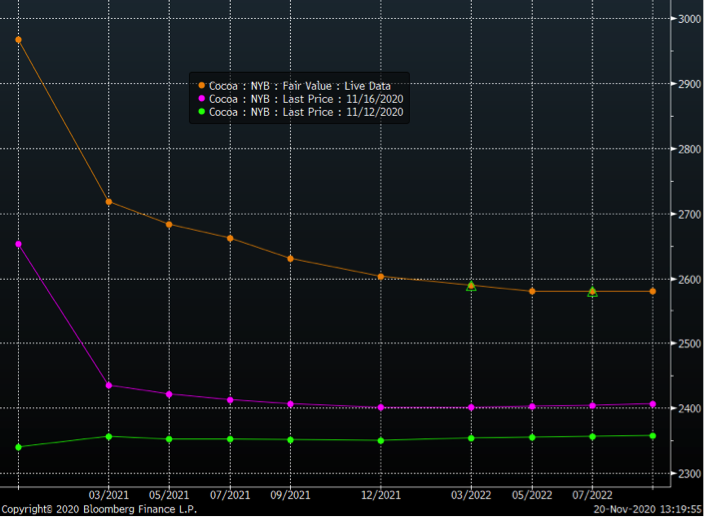

Nitesh Shah (Wisdom Tree) | Earlier this year top cocoa producers, Ivory Coast and Ghana implemented an extra fee of US$400 per ton of cocoa on top of the Free Onboard Price (FOB), which they call a living income differential (LID). That is applied to the 2020/21 marketing year (which started in October 2020) and will remain for the rest of the marketing year (and a new fee will be decided next year). Essentially buyers importing cocoa from the two countries through bilateral contracts are paying more for the cocoa to help reduce poverty of the farmers producing the crop. However, market prices for cocoa are weak reflecting the subdued demand for cocoa in the pandemic-stricken era. So, New York traded cocoa futures contracts up until last week were reflecting weak demand. Some buyers have turned to the New York futures to purchase their cocoa. Monday 16th November was the first date traders had to notify counterparties they intend to take physical delivery to settle contracts expiring December 15th. On Monday 16th November, the price of the December 15th contract surged, reflecting that the contract was under-priced last week. That has taken the futures curve that was in contango[1] on Thursday 12th November into a steep backwardation[2]. The timing indicates the price move was driven by commercial traders rather speculators.

Source: Bloomberg. Orange line: 20/11/2020; Pink line: 16/11/2020; Green line: 12/11/2020

X-axis is the maturity date of the futures contract and y-axis is the price of the contract in US$/metric tonne

Historical performance is not an indication of future performance and any investments may go down in value.

[1] When the price of a futures contract for delivery at a later date is higher than the futures contract for delivery at a nearer date.

[2] When the price of a futures contract for delivery at a later date is lower than the futures contract for delivery at a nearer date.

[3] When the price of a futures contract for delivery at a later date is lower than the futures contract for delivery at a nearer date.

While we have seen a lot of price movement on the front-month December 2020 contract, the ‘active’ contract and the contract currently tracked by the Bloomberg Commodity Cocoa Subindex is the March 2021 contract. The price of that contact, while having risen, has not gone up as much as the December 2020 contract.

So where next?

Bull – The March 2021 ICE US Cocoa contract could experience the same tailwind as commercial buying pushes up prices as we approach its delivery date. As December 2020 contracts are delivered, inventory is further depleted, helping March 2021 prices rise closer to Ghana and Ivory Coast prices. News of potential vaccines for COVID-19 could raise demand for cocoa in the coming year.

Bear – Cocoa demand is still weak and could take some time to rebuild. We live in an era of social-conscious consumers. Could a consumer backlash deter cocoa buyers from taking delivery in New York instead of buying directly from West Africa?