J.L. M. Campuzano (Spanish Banking Association) | Little by little it’s being acknowledged. Just this Thursday, the President of the ECB openly admitted that monetary policy has its limits in terms of driving growth and stimulating inflation.

And in fact, history tells us that monetary policy is more efficient for fighting inflation than for creating it. But Draghi made the traditional statement that there is room for further action via monetary measures. He is still efficient. So what is the problem? It’s that the current economic weakness is not down to a lack of liquidity.

Is there really room for further monetary policy measures? Eight years ago the IMF Managing Director stated that expansionary monetary policy could be limitless. But according to the conclusions of a recent article from the organisation, that’s not quite so clear now.

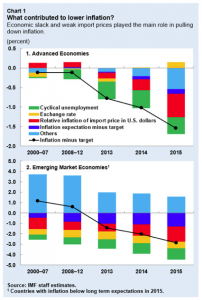

What are the factors behind low inflation? Weak demand, the infra-utilisation of installed capacity, the drop in international prices…Raw material prices? Not just those prices. In fact, the strong economic interconnection means there is feedback from all these factors on a global level.

Incidentally, I find it striking that the IMF doesn’t include in its study the high level of public debt and the private sector’s deleveraging to explain the deterioration in the inflation outlook.

In summary, an expansionary monetary policy with zero interest rates may even aggravate the weak outlook for inflation, making it even worse ahead of potential low inflation figures. What should be done then? A combination of measures. And the IMF alludes to reforms and expansionary fiscal policy. Amongst those reforms, measures aimed at boosting salaries (the ECB President also said this just on Monday), as well as others to encourage debt adjustments. Or unproductive assets in the case of the banks.