Degussa | Gold is a “good” that has a truly global demand, and i ts price is determined by numerous factors. One of those is the market interest rate. The reason is obvius: Gold does not have an “inherent interest rate”. The holders of gold have to bear “opportunity costs” by forgoing income they would enjoy if, for example, they kept in sight – , time – and savings deposits or short – dated debt (which may be considered the closest substitutes for gold in the financial sphere). As a result, one would expect that falling (rising) interest rates will encourage (discourage) the demand for gold, thereby increasing (decreasing) the price of gold (other factors being equal).

1.-Gold price rises as interest rates go up – how come?

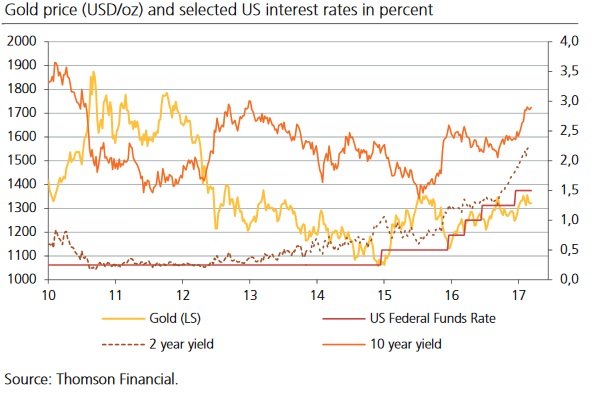

In real life, one would have to expect that various factors influence the demand for and supply of gold at the same time . For instance, there might be periods in which interest rates go up, and the price of gold remains unchanged. How come? The reason may be that other, non-interest rate – related demand factors take hold (such as, for example , increased demand for gold for industrial purposes). However, we do know that the price of gold would have been lower were it not for the additional gold demand that has supported the gold price. That said, just eyeballing a chart showing the price of gold and the interest rate will not tell you the entire story about the interdependency of the price of gold and the interest rate. In fact, the negative relation between the price of gold and the interest rate is, and can be assumed to be, economically well established. Since the middle of 2012, the short – term interest rate in the US has been rising – as markets expect ed the Federal Reserve (Fed) to move towards policy tightening. Since the beginning of 2015, this development was accompanied by a decline in the price of gold (a s one would expect) . Also, investor risk aversion fell, and the demand for gold as a “safe haven” decreased. After that, the price of gold went up as short – term interest rates moved sideways and long – term interest rates dropped. As from 2016, short-and long – term interest rates went up, and so did the price of gold. Keep in mind that in all these market phases a negative relationship between interest rates and the gold price was at work – but it might have been concealed by price effects stemming from other factors.

2.Gold price, real interest rates and the money supply in the long-run

What about the relation between the real – that is the inflation – adjusted – interest rate and the price of gold? As figure 2a shows, the two are closely and negatively related (as one would expect) . Since the beginning of 2017, the US long – term real interest rate has returned into positive territory, while the price of gold has increased. This is an excellent illustration of a situation in which non-interest rate -related factors (e.g. growing industrial demand) override the consequences higher borrowing costs have on the demand for and thus the price of gold.

It may not be too surprising that despite higher interest rates investors’ appetite for gold has returned. On the one hand, rising interest rates can be interpreted as a sign that the economies are, slowly and gradually, getting back to “normal”. On the other hand, however, rising interest rates represent a growing risk to the economic and financial structure: The latest cyclical upswing has been orchestrated by central banks ’ ultra-low interest rate policy. The Fed’s tightening policy is like taking away the “punch bowl”, and if it raises interest rates too much, the party would definitely come to an end. It is against this backdrop that gold, even in times of slightly higher real interest rates, is increasingly attracting investors, which has ultimately led to a price increase.

In a long-term perspective, one would expect a positive relation between the price of gold and the quantity of money. An increase in the money supply inevitably leads to a rise in prices of goods (compared to a situ a tion in which the increase in the money supply has not occurred). This, in turn, reduces the purchasing power of fiat currencies (be it the US dollar, the euro, the Chinese renminbi or the British pound ) . If and when gold is in dem and for monetary purposes , one would expect that the price of gold (in terms of fiat currencies) rises as the quantity of money in creases. In other words, the price of gold should, over the long – run, compensate its owner for the loss in the purchasing power of fiat currencies.

What is more, the current price of gold does not seem to be “dear”. In fact, it appears that it has upside price potential. Clearly, the interest is a key factor in the short – run. If the Fed does not hike in- terest rates beyond current market expectations, gold stands a good chance to go up in price sooner rather than later. And if borrowing costs go up by more than what is currently expected, the rather elevated level of “excess liquidity” may provide a cushion, preventing the price of gold from dropping substantially, and – perhaps even more important – for a prolonged period of time.

At the current price, there is good re ason to expect that gold can serve as insurance against the vagaries of the fiat money system , providing its owner with optionality: the upside price potential of gold in times of crisis – and in a fiat money system a crisis will return at some point, unfortunately.