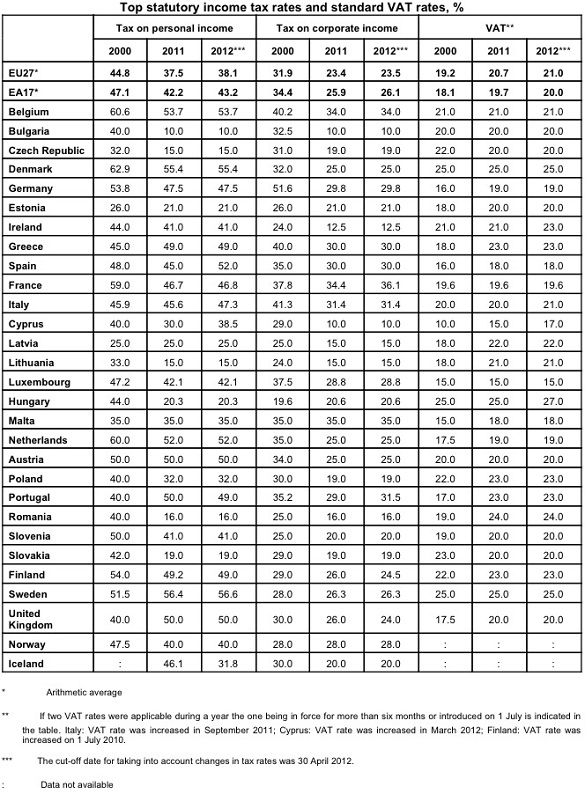

Taxpayers may be under the impression that their pockets have suffered an increasing attention from their countries’ administrations. They are right to complain. The average standard VAT rate in the EU has risen strongly since 2008. In 2012, the standard VAT rate varies from 15.0% in Luxembourg and 17.0% in Cyprus to 27.0% in Hungary and 25.0% in Denmark and Sweden, data from the 2012 edition of taxation trends in the European Union showed Monday. The information was issued by Eurostat, the statistical office of the European Union, and the Commission’s Directorate-General for Taxation and Customs Union.

The top personal income tax rate in the EU has gone up in 2012. The highest top rates on 2012 personal income are observed in Sweden (56.6%), Denmark (55.4%), Belgium (53.7%), the Netherlands and Spain (both 52.0%), Austria and the United Kingdom (both 50.0%), and the lowest in Bulgaria (10.0%), the Czech Republic and Lithuania (both 15.0%), Romania (16.0%) and Slovakia (19.0%).

Corporate tax rates in the EU, though, have risen slightly in 2012, ending a long declining trend, nevertheless. The highest statutory tax rates on 2012 corporate income are recorded in France (36.1%), Malta (35.0%) and Belgium (34.0%), and the lowest in Bulgaria and Cyprus (both 10.0%) and Ireland (12.5%).

The overall tax-to-GDP ratio in the EU stood at 38.4% in 2010, unchanged from the year before. After the marked drop in 2009, consolidation measures and a modest recovery of the economy led to a stabilisation of tax revenues in 2010. The overall tax ratio in the euro areq fell slightly to 38.9% in 2010, compared with 39.0% in 2009.

Be the first to comment on "Highly tax-charged: it’s personal in Sweden, corporative in France"