Although the first signs of uncertainty have begun to emerge on the Asian continent with listed real estate companies trading at discounts, real estate fundamentals remain largely trusted. From the macro-economic perspective, Asian giants, China and India, continue to enjoy GDP growth rates of 9.1% and 7.7% respectively in Q3 2011, while other significant markets such as Singapore and Hong Kong also witnessed GDP growth of 6.1% and 4.3% respectively in Q3 of this year.

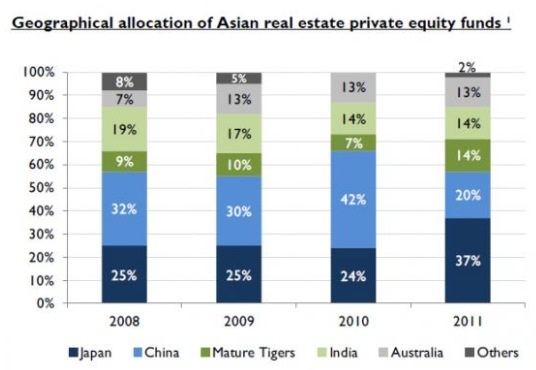

But regardless of its strong economic indicators, China and India were not the main target markets within the industry in 2011. Asian real estate private equity funds have a new favorite, Japan.

With $7.4 billion (€5.6bn) and a market share of 37% for the first 9 months in 2011, Japan tops the shopping list of fund managers for the first time in years. Compared to 2010 (target equity: $2.7bn), the target equity for Japan has almost tripled with its market share increasing by 13 percentage points year on year.

The question remains: what are fund managers seeking in a market that has been recording stagnating growth and real estate returns for years and in addition, a destination regularly plagued by natural catastrophes?

Many indicators are currently in favour of the Japanese real estate market. Firstly, after the US, Japan is still the second largest market in the world in terms of commercial real estate and the largest and most liquid market in Asia. Following the events at Fukushima, the already significant price correction continued but has bottomed out in the meantime.

However, initial yields are still far from peak levels of 2007-2008. Rental levels have also significantly corrected and fell in major cities such as Tokyo by an average of 44% compared to the peak levels. Nevertheless, this price correction has proved somewhat beneficial in relation to vacancy rates, as tenants who could no longer afford CBD rents are returning to the business districts of Tokyo. Consequently, the vacancy rate for office space in Tokyo decreased from 7.0% in Q4 2009 to 4.6% in Q3 2011. It is therefore not surprising that 28% of the equity ($2.1bn or €1.5bn) targeted by private equity real estate funds in 2011, are earmarked for office investments.

Similar to their European and US peers, Japanese banks are increasingly feeling the pressure of liquidity constraints and new financing or re-financing of real estate transactions are only possible with higher levels of equity than was required before the financial crisis. This has created interesting opportunities from the perspective of fund managers who are increasingly launching debt funds which aim to bridge these financing gaps. For the first 9 months of 2011, $2.7bn of target equity was being raised for debt investments in Japan.

Be the first to comment on "Japan, Asian real estate private equity funds’ favourite destination"