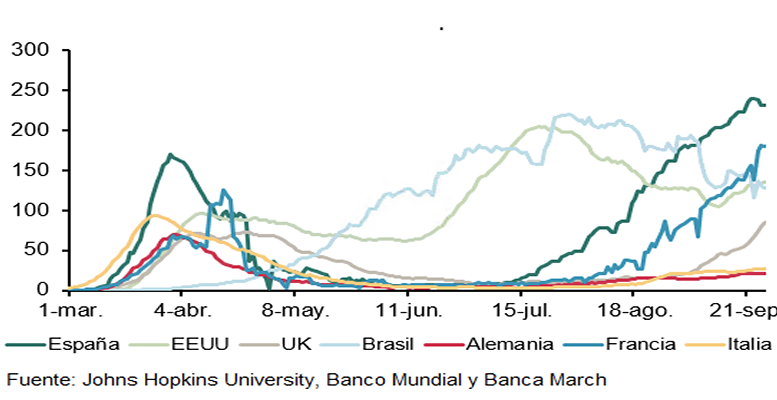

Michael McEachern (Muzinich Global) | With less than 50 days before the US elections, market participants will be preparing their portfolios for turbulent times ahead. New Covid-19 cases continue to rise, and particularly in some US states and European countries, worryingly so. In our view, the proximity of the elections in the US leaves the debate about further fiscal stimulus in a no-man’s land, where it is difficult to see a quick and impactful resolution. We believe the prospect of some partial lockdowns in Europe confirms that the March-April general lockdown treatment will not be implemented again. But the fact that the virus eradication is taking much longer, and has inflicted more pain than expected, means that fiscal and monetary policy responses will have to adapt to support the economies for an extended period.

So far, 2Q earnings in the US and Europe were better than the depressed expectations but were not good in absolute terms. In parallel, the new issuance program by US corporations has been far larger than expected a few months ago, in response to persistent demand. What was first an Investment Grade corporate wave of issuance has also become a High Yield phenomenon over the summer, and September seems very busy as well. This means that credit metrics are deteriorating, but not as much as feared initially. We see this as a rather good development, supporting the view that this is time for carry and not for trading.

Regarding portfolio construction, we believe shifting from “stay at home” to more cyclical sectors has made sense over the last few weeks. It is now time to focus on the best opportunity for carry, selecting “survivors” from those which will face the extended Covid-19 challenge with difficulty, and to distinguish those corporates that have built a liquidity wall to help them navigate the next few quarters to the more fragile companies that will have to come back time and again and may face “issuance fatigue” from the markets.

From a performance standpoint, August was the fifth month in a row with positive excess return for developed credit markets. In our opinion, the risk on the equities market for the next few weeks means that credit spreads may face short term volatility again. However, we believe this will increase the bifurcation between the strong and the weak credit and could provide interesting opportunities to take on board resilient credits with low valuations but nice yields.

While central banks continue with the ultra-low rates, so that the health crisis does not turn into a financial crisis, their tolerance for inflation highlights fears surrounding the economic recovery. But wishing for inflation doesn’t make it so, and in our view there are massive deflationary headwinds (high unemployment, technology) that pose considerable challenges.

We are carefully watching UK and EU negotiations regarding a trade deal after the transition period is over, as a no deal would add disruptive impact to the possible economic impacts of resurgent Covid-19 infections.

We believe spread product, such as high yield, provides the best source of current yield, which may offer some protection against unanticipated rise in rates. In our view, credit can offer versatility for these somewhat more optimistic —but still uncertain —times.