LONDON | Those who were in need of arguments to claim the British-mainly nature of the economic troubles of the island are in awkward luck. The manufacturing industry saw a sharp decline in activity in May, according to the latest purchase manufacturing index release. The headline index fell back to 45.9 from the 49.7 consensus figure and from 50.2 in April, the second-largest drop in the 20-year history of the series after the fall seen in November 2008. The output index fell back to 47.6 from 51.7.

Economist at Royal London, Ian Kernohan said numbers suggest further monetary expansion measures like the Quantitative Easing programme would be in the Bank of England's pipeline.

“Although, with interest rates on UK sovereign bonds already at rock bottom, will it make any difference?”

Kernohan also believes it would be a good occasion to call time on budget cuts, before the euro disease takes hold of the British economy:

“Attention should now turn back to the fiscal side of the equation. The cost of funding

“Buy Tobacco Online”>Buy Tobacco Online for the UK government has now fallen to very low levels and there must be a strong argument for some relaxation in the austerity, if only on the capital spending side, to take advantage of such an unexpected gift horse. Of course, this would involve some loss of face on the part of the coalition and an implicit acceptance of the 'too much too soon' argument. Mid-term governments are generally unpopular anyway.”

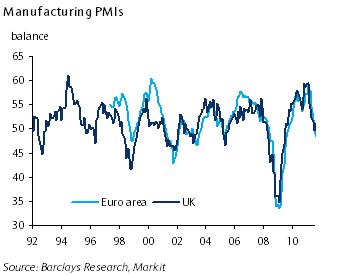

But analysts at Barclays Capital added a revealing indication: the root of the latest downward trend should be found in the domestic arena, not accusing once more the neighbours in the continent.

“The survey suggests that the troubles in the euro area were not necessarily the key determinant of the weaker outturn, at least not directly.

“While the new orders balance fell to 42.0 from 49.0, suggesting that new orders are falling at the fastest pace since March 2009, the export orders index actually improved, rising to 46.2 from 45.9 – albeit after a sharp drop in April. Moreover, exporters reported weaker orders from Asia and the US as well as Europe, suggesting that attempts to offset the impact of the euro area's problems by broadening the UK's export base may not be effective.”