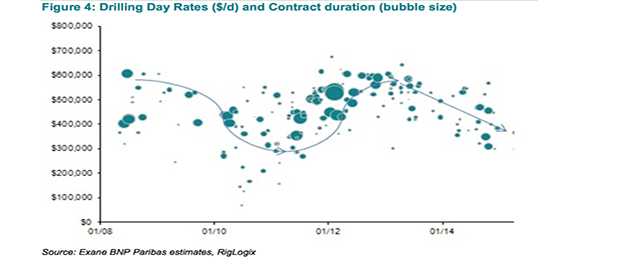

Odjfell recently announced the contracting of its Deepsea Metro I Ultra Deepwater Rig for a day rate of $285k/day (perhaps even lower once mobilisation fees are taken into account), representing a new low for the sector. Deepwater day rates for floaters have dropped by more than $300k/day since their peak in 2013, as excess capacity in the rig market has exacerbated the impact of low oil prices on new project sanctions.

Not only are new contract rates getting lower, they are also getting shorter- clients are spoilt for choice and do not have to commit to lengthy contracts. While we have seen assets being retired in recent months, this is being more than offset by new rig additions in 2016/17. We believe that the pace of asset destruction needs to accelerate from here, and only expect leading edge day rates to recover in 2017.

A Lesson in Mining Capex

Comparing the mining and oil sector always generates a lot of interest during our marketing. In fact, one of the most asked questions during our Q1 marketing was: “would you buy Shell or Rio Tinto?”. We would be sceptical of any such comparisons. Despite both being extractive industries, they are very different from an investor perspective – commodities with very different end markets, varying reinvestment needs and different levels of industry fragmentation. While there are further differences, here we focus on one big similarity – the recent capex cycle.

Structurally, we should expect mining companies to benefit from a lower reinvestment need given lower decline rates of course. However, the China boom post financial crisis kicked off a significant growth drive not dissimilar to what we saw a year later in the oil sector. Of course, the weakness in metal prices that kicked off from 2012 sparked a dramatic U-turn with a series of aggressive capex cuts from 2013. Oil prices held up longer but have seen a similar reversal…capex cuts are now following.

Be the first to comment on "Oil sector – Drilling deeper: It’s the demand, stupid"