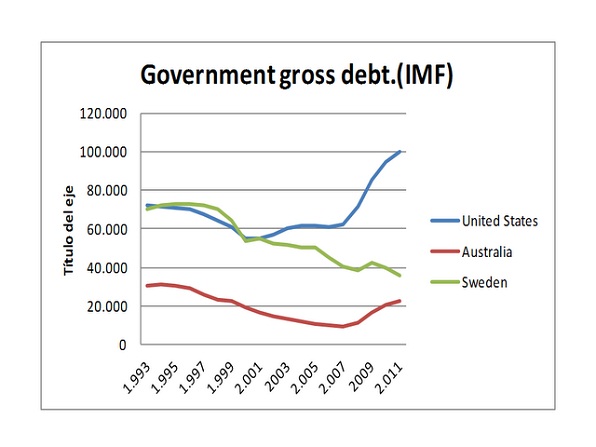

By Luis Arroyo, in Madrid | The reason? Well, their States are exemplary. No banks in trouble, no massive public debt but a very aggressive monetary policy to grease the inevitable deleveraging process. Let us compare them to the US, for instance, whose gross debt to national GDP has already touched the 100pc base. This, I suppose, should shake the beliefs of old Keynesians like Krugman, stubbornly champions of a fiscal retrenchment that neither Australia nor Sweden have felt the need for. Equally, this refutes market monetarists in their logic that the initial conditions of unbalances mark how efficient a monetary policy can be and when it is convenient to push the brakes.

Professor of Economics at Bentley University Scott Sumner, though, tells me there is no correlation here. My answer: Ricardian equivalence over expectations. An expansive monetary policy with a 100pc debt to GDP will not spark the same expectations as one with a 30pc debt to GDP. It is impossible.

Be the first to comment on "To Mr Scott Sumner: this is why Australia, Sweden succeed against the crisis"