Investors are concerned about when and how fast the Fed will hike interest rates. The mystery surrounding this issue is how the markets will react to this rise in the short, medium and long term, in order to decide on an investment strategy.

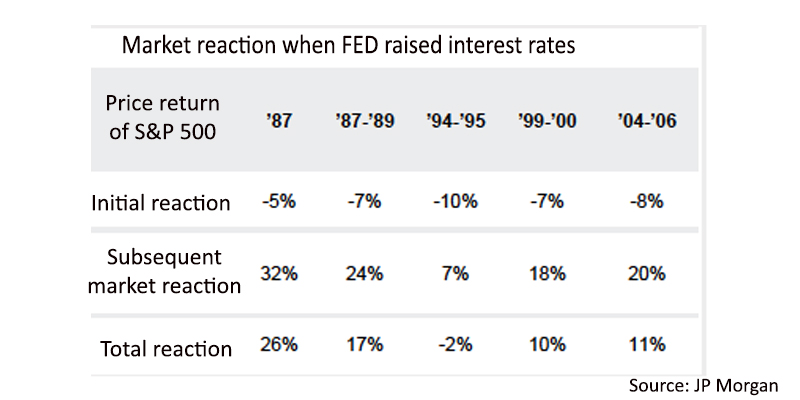

SelfBank analyst Felipe Lopez discusses this topic in the context of a study published by JPMorgan on how equities have historically responded to the Fed’s interest rate hikes over the last five periods (1987, 1987-1989, 1994-1995, 1999-2000 and 2004-2006).

Lopez explains that the “initial reaction” represents the period when the markets are beginning to reflect the first rate hike in prices until the date of the second hike. The “subsequent market reaction” is the period between the second hike to a point which is considered the end of the rate hike cycle, while the “total reaction” is the change in the market throughout the cycle of rate hikes. The following graph shows the data:

Selfbank’s Lopez draws the following conclusions from this study:

- Based on historical data, investors should expect a negative initial reaction from the American equity market.

- Similarly, the subsequent reaction from equities is completely different from the initial one, and investors should expect positive returns during this period.

- Also based on historical data, the overall reaction is expected to show positive returns in US equities, doing well on aggregate on the upcoming rate hike.

The Selfbank expert highlights the volatility coming from Asia as one of the focal points prior to the rate hike. The main concern here could be the possible spread to European markets, hampering the gains clocked up in recent months as a result of the ECB’s stimulus measures.

Natalia Aguirre, Director of Strategy and Analysis at Renta 4, believes the most likely scenario is that interest rate hikes will start after the summer, as the Fed has been showing an appreciable optimism regarding the outlook for the economy. She also notes that the Fed remains confident inflation will gradually return to its medium-term objective of 2%.

Furthermore, Aguirre expects that as soon as the rate hikes confirm these forecasts, ‘the stock markets should perform well. But we can’t rule out some volatility, given that the rate hike would respond to a monetary normalization as a result of a significant improvement in the American economy.’

Intermoney’s Analysis Department Head, Diego Triviño, coincides with market consensus that the rate hike will take place in September or October. While some emerging economies in particular may experience difficulties after the hike, he says he does not foresee any risk of a systemic crisis.