Today is Environment Day and it is time to take stock of how the private sector is contributing to reducing the carbon footprint. Greenhouse gas emissions play an important role in global warming and, although business has long been trying to reduce them through energy efficiency programmes and similar initiatives, the urgency of the climate crisis is raising the bar significantly. In this article Roland Rott, director of La Française Sustainable Investment Research, analyses the real problem in achieving net zero carbon claims.

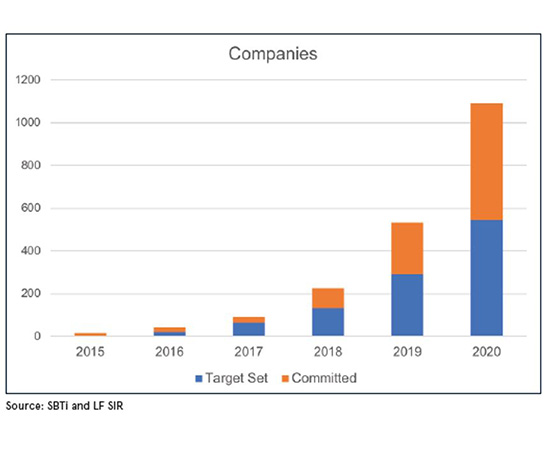

In the last twelve months, the number of companies that have committed to Net-Zero carbon emissions has doubled again. An estimated quarter of global CO2 emissions and more than half of global GDP are already part of Net-Zero commitments. However, the gap between the ambition to reduce CO2 emissions to zero in the coming decades and the reality is wide. It is still difficult to determine how such voluntary commitments will lead to target achievement. More clarity is desirable here.

Greenhouse gas emissions play a major role in global warming. That is why the private sector has long sought to reduce CO2 in the atmosphere through energy efficiency programs and similar initiatives. The urgency of the climate crisis, however, raises the bar significantly. Due to the Paris Agreement in 2015, more and more countries are articulating their ambitions in this regard. For example, six countries have already enshrined their Net-Zero targets in law, five countries have proposed legislation to this effect, 14 countries have developed guidelines, and many more countries are currently considering introducing Net-Zero targets. The EU, for example, intends to be the first continent to become carbon neutral by 2050 through the European Green Deal.

Therefore, in the private sector, reducing CO2 emissions has become a strategic goal that goes far beyond the well-intentioned environmental targets of the past. Today, CO2 reduction is already a priority for many companies and their stakeholders – including shareholders and debt providers. That is because the stakes are significant in the upcoming transformation of the economy toward zero-emissions growth: business models are becoming obsolete, new corporate activities are emerging, adaptations are necessary, and each company must disclose its specific response to climate change.

However, due to the voluntary nature of the most Net-Zero commitments, companies may state targets without anchoring them concretely in the business plan. What is urgently needed, therefore, are Net-Zero ambitions that are backed up with science-based interim CO2 reduction targets. What business measures will be taken within the company over the next five years to move significantly closer to the Paris Agreement target? A recent study shows that companies that have set themselves short- and medium-term targets are reducing emissions at a much higher rate than the overall economic average.

Not surprisingly, banks, insurers and asset managers are increasingly being invited to actively manage climate risks and opportunities in their portfolios. However, at present, a well-diversified portfolio can only be as climate-friendly as the average of the companies listed on the market. The new EU Climate Benchmark has therefore defined, for example, as a requirement that the CO2 intensity of the portfolio must be reduced by 7% each year in order to be compatible with scientific climate targets. Therefore, there is a measurement problem as well as an incentive problem. Investors are well equipped to play a critical role in enforcing the CO2 reduction targets of portfolio companies. This is because methods very similar to those used in financial analysis are needed for investors to sanction metrics such as earnings growth, cash flow and balance sheet ratios. The challenge for investors here is to integrate ESG data and climate research insights into the investment process. It is a demanding and meaningful challenge. Armed with this knowledge, a constructive dialogue between companies and investors will also be able to develop. The greater use of AGM voting rights should provide additional incentives for this engagement.

Looking ahead, it is expected that significantly improved reporting standards will make it easier for the financial sector to set ambitious CO2 reduction targets for investment portfolios. This increases the pressure on portfolio companies to take concrete short- and medium-term measures and, in the competition for capital, to deliver the urgently needed transformation solutions for Net-Zero 2050 already in this decade.