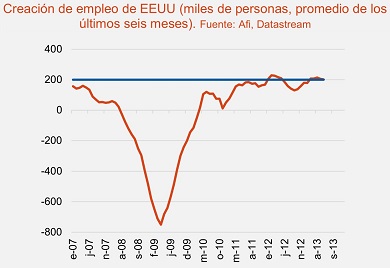

In the US, employment grew in the non-farming sector by 195,000 new jobs. Will the Eurogroup talk about it during their last meeting today, or will Eurozone finance ministers keep tackling country by country–after Greece–avoiding the bigger picture? Those in Europe pushing for lower interest rates and more expansionary monetary policies from the European Central Bank will surely use this chart as an argument.

The truth is that analysts are confident the job creation trend sparked by the Federal Reserve’s money injections will trim unemployment down to 7.3% by the end of the year from the current 7.6%.

While the pro-austerity party will dismiss these meagre and costly advances, spending in construction has gone up with home investment increasing at a 12% annual rate and domestic demand is recovering. Also, BNP Paribas broker Cortal Consors remarked in a report to investors that June’s manufacturing and non manufacturing index records in the US are placed in expansionary economic territory–over 50 points– with 52.2 points and 53 points, which in the Eurozone averaged 47.8, still in contraction mode.

Eurozone leaders must be helplessly looking at the other side of the Atlantic with at the very least a moderate degree of envy: as Bankinter Broker noted, “in the first half of 2013, the US has created an average of 220,000 jobs per month, this being the best figure since 2005.”

Be the first to comment on "Tuesday’s chart suggestion for the Eurogroup: the US is generating jobs"