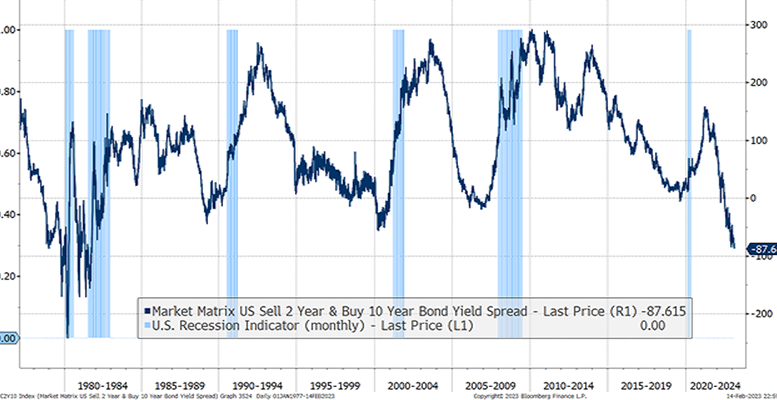

The unexpected US retail sales data triggered a sharp rise in yields, especially the 2-year UST, which reached almost 4.70%, pushing the inversion of the 2s10s curve above 90 bps for the first time since the early 1980s, and extending expectations of Fed tightening into the summer. The swap market was even discounting an interest rate peak of 5.30% in July.

US Yield curve inverted by almost one point