Stock repurchases by corporates have by far been the most dominant source of demand for American equites in the current bull market. According to figures of AXA IM, equity buybacks since the global financial crisis, for S&P 500 companies, have totalled more than US$3.5tn, continuing a phenomenon that began around three decades ago.

The increasing use of stock repurchases to pay back equity investors (instead of dividend payments) was triggered around the 1980s. This has been often attributed to the decreasing cost of debt financing, driven by falling interest rates, regulatory changes involving stock buybacks and the rise of equity -linked compensation for executives.

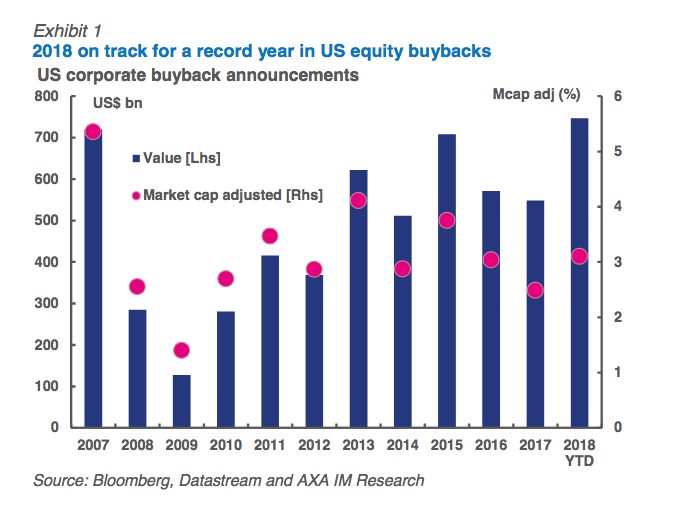

Buybacks still appear to be a strong tailwind for markets amidst the volatile backdrop, while contributing to earnings -per -share growth. The trailing total cash yield (buybacks plus dividends) for the S&P 500 now stands at 4.2%. Looking at announcements until end of March, 2018 looks set to be a record year for buybacks in the US with around 60 S&P 500 companies announcing share repurchases totalling close to US$185bn. Announcements are around 58% higher , relative to the same period last year, despite concerns about the rising cost of capital, elevated leverage ratios and tightening credit market conditions as fundamentals remain solid – reflected by recent earnings trends.

Sector contributions of buybacks have generally been in line with the benchmark composition, with the technology and financial sectors being the largest sponsors. The gross cash returned to shareholders through stock repurchases stands close to 65% for these sectors with the balance paid thr ough dividends. The move to buybacks is clearly observable in all sectors besides utilities and telecommunications, where more than 90% of shareholder pay-out is still in the form of dividends.

Generally speaking stock repurchases are well received by the market. More often than not , it appears like the actions are aligned with both investor and management interests. On the face of it buyback operations, like dividend payments, are simply a way to return excess cash to shareholders, although the underlying mechanisms make them a superior instrument.

A firms’ weighted average cost of capital can be effectively optimised by essentially arbitraging the cost of equity and cost of debt. This could be thought of as a static trade- off framework , where an optimal debt equity mix is found by weighing the costs and benefits of leverage, keeping assets and investment plans constant 3 . Assuming stock repurchases are conducted with financial prudence – they can positively impact shareholder value by optimising capital structure. The large funding cost gap between debt and equity in 2012-2013, at a time when corporate fundamental s were improving and debt affordability was solid, triggered the buyback boom.

Prevailing taxation regimes also provide a tax shield on debt financing, as interest expenses are deductible unlike dividends payments. Expectedly there is a tipping point to this equation, as pushing the debt equity mix beyond a threshold, alters the risk profile of a firm, which is consequently detrimental to its value.

A lower share count means higher earnings per share (all else being equal) , implying a better return on equity. As this is created purely through financial engineering – the longer -term impact on firm value remains contingent on the sustainability of earnings growth generated through existing operating assets and the judgement managers demonstrate with the trade- off between investing capital in new projects and returning cash to shareholders. Indeed short -sighted behaviour on the part of management, forgoing profitable projects to “make the quarter” would impair long- term value creation as would “empire building” by making poor investment decisions.

Stock repurchases also provide more flexibility compared to dividends. Buybacks can be used to signal the market when management feels their stock is undervalued or mispriced. Unlike dividends which are distributed to all the shareholders of a firm, share repurchases offer investors the option to tender their holdings or not, altering the ownership structure of the company. The tax consequences could also differ on dividends and capital gains, the key factor driving “ownership clientele” effects positing that companies make cash distribution decisions based on the tax consequences to their investor base. Stockholders receive dividends whether or not they need cash at that point in time.

Lastly, buybacks are not generally prone to the “sticky dividends” phenomenon where dividends paid anchor expectations and dividend cuts tend to be badly received by markets. This implies that managers enjoy higher flexibility regarding pay -out and reinvestment policies. Managers are also increasingly motivated by stock prices as they are incentivised by shareholder return linked compensation. In the US , 72% of chief executive officers have equity -linked compensation.