Alphavalue | Against growing environmental constraints, as well as an uncertain perspective on hydrocarbons, oil companies are modifying their strategy. The electrification of the energy mix appears as an opportunity for the mutation to integrated energy companies.

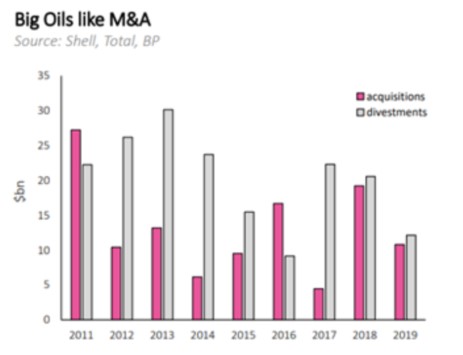

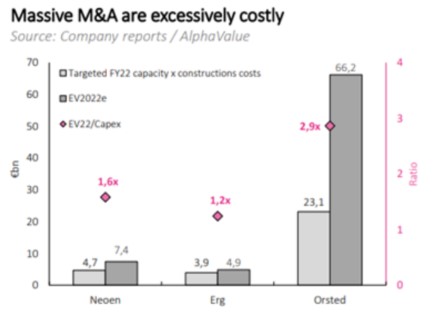

The big oil companies want to be a part of the growing market of renewable energies, but they will compete against the powerful utilities. A balance will have to be found between the speed of this transition and its cost. While mergers and acquisitions are the fastest way to achieve the goals, it is also an expensive route. It could be better to develop their own solar and wind farms, as well as partnerships.

We highlight four graphs that explain this situation.

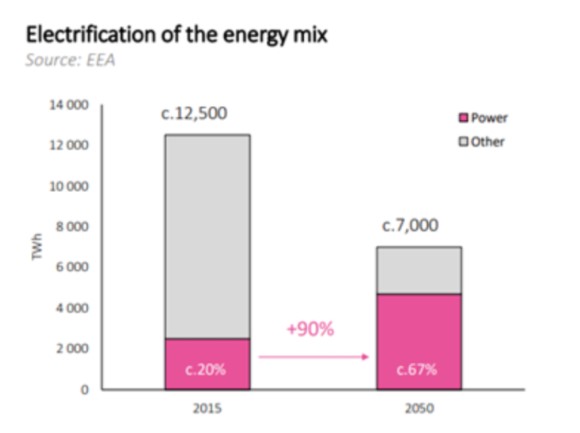

The first one is that tomorrow’s energy will be electrical energy at the expense of everything else (fossil resources).

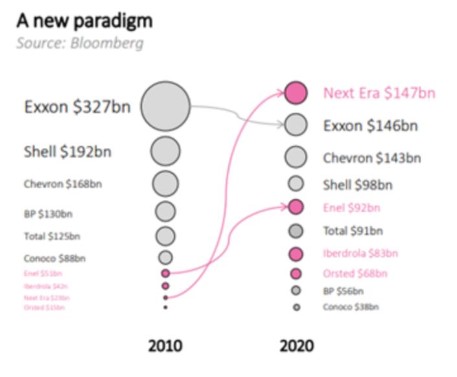

The second shows that oil companies have lost the battle of valuation against utilities.

This third one is about M&A (mergers and acquisitions).

And the fourth refers to the fact that the big alternative energy firms are out of reach of the oil companies due to the high valuations.

The conclusion is that oil companies must make this energy transition organically. It will be a slow process.