Bank of Spain governor bids farewell, recalling that Spain has not been converging with rest of Europe for a decade

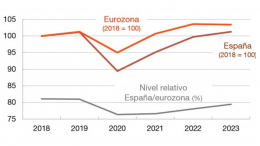

“Europe is lagging behind the rest of the major economies and Spain has not been able to achieve sustained convergence in per capita income with the rest of our European partners for more than a decade,” said Pablo Hernández de Cos, governor of the Bank of Spain, who left office yesterday after six years at the helm of the Spanish central bank. The Spanish banker called for “ambition and great…