Central banks are not omnipotent

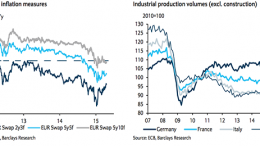

MADRID | April 26, 2015 | By Luis Arroyo | After effusively congratulating the progress of the Spanish economy in his last press conference, Draghi said that some labor reforms are missing. Let’s connect the dots: the ECB’s president is attributing himself the merit of recovery with his expansionary monetary policy, while the demerit that this is not stronger is attributed to Madrid, which is not undertaking enough reforms.