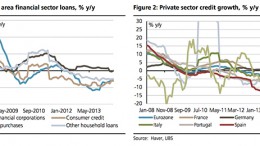

MADRID | The Corner | The ECB disappointed all those who were keen to gain more concrete information on how it wants to expand its balance sheet over the coming months. Instead, Mr Draghi pointed out that inflation expectations, not balance sheet size, remain the ultimate yardstick of current and future ECB action. “We think this is the right communications strategy as we had become concerned that the ECB would set fairly explicit balance sheet targets that it might struggle to attain. The ECB offered a more cautious assessment of the growth and inflation outlook and left the door open for additional unconventional measures. Nevertheless, our base case scenario remains that sovereign QE will not be triggered,” UBS analysts commented.