What If Investors No Longer Roll EM’s Debt Over?

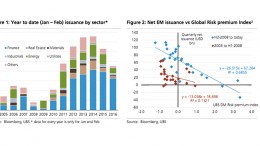

UBS | Between 2010 and 2014 global investors showed tremendous generosity towards EM, helping it issue forever larger amounts, and easily roll over debt coming due. In 2015 sentiment began to sour, and the primary market is even less benign today.