Europe: Calling a spade a spade

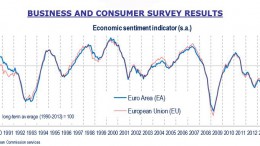

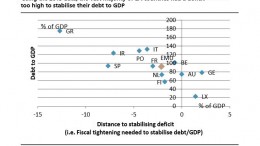

SAO PAULO | By Marcus Nunes via Historinhas | Tim Worstall comes out and calls a “spade a spade” in “Europe Doesn’t Have A Debt Crisis, Europe Has A Monetary Crisis”: The stock markets plunge over concerns about the eurozone; there’s a flight from lower quality sovereign bonds; Greek, Spanish and other periphery bond yields spike. It looks like the eurozone debt crisis is back. But this time around we really should get to grips with the fact that what we’ve got here is really not a debt crisis.