Earnings season: Mixed feelings on both sides of the Atlantic

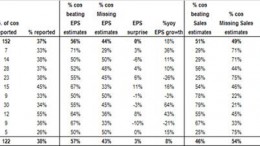

MADRID | The Corner | We’re in the middle of second-quarter earnings season and companies are showing their cards to investors. Note the difference on both sides of the Atlantic: in the US, 53% of S&P500 firms have posted their results and 78% have performed better than expected (average surprise of 6%, JP Morgan analysts pointed out). EPS growth is of 11% yoy, while sales went up by 5% with 67% of companies having better than expected numbers. Meanwhile in Europe, with 152 SXXP companies having posted their results, 56% have turned in an average +0.4% EPS. Year-on-year EPS has risen by 18% (8% if we exclude financial entities), although yoy sales decreased by -2%.