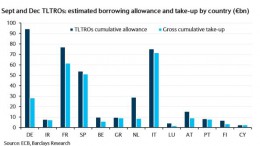

Spain will join countries guaranteeing ECB’s ABS

MADRID | The Corner | As expected, eurozone finance ministers have yet to agree on the guarantees requested by Mario Draghi for the riskier asset-backed securities (ABS), the so-called mezzanine level. Some countries such as Spain have already expressed their intention to guarantee them if some country of the zone euro did. Spanish economy minister pointed out that securitizations in Spain would not be at a comparative disadvantage. For the time being, not Germany nor France or the Netherlands will grant any collateral to the financial sector.