What the market is really telling about the US recovery

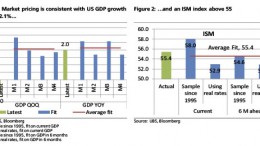

LONDON| By Stephane Deo and Ramin Nakisa at UBS | At the time of writing, the Treasury curve is telling the potential US GDP growth rate is very low – in the neighbourhood of 1%. The 30-year real yield is at 1.09% (but dipped below 1% recently), the 10-year real yield is at a frightening 0.36%, and the 5-year-in-5-year yield, a good proxy of where the market thinks long-term growth will settle, is at 1.05% (but also dipped below 1% recently).Taking those numbers at face value, we would have to conclude that the current recovery is doomed, and that growth will level off soon at a very disappointing level.