Russian sanctions start to impact on Europe’s export powerhouse

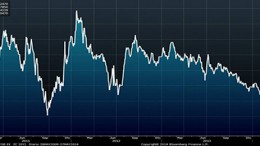

BERLIN | By Alberto Lozano | While yesterday downs on Wall Street were marked by rising tensions in Ukraine, negative data from German manufacturing orders also seem to to be influenced by the geopolitical risks and the Russian sanctions’ impact on the eurozone’s economic recovery.