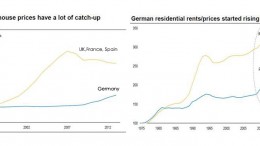

MADRID | The Corner | Historically, German housing prices have remained flat, but since 2011 they have increased by 30% (a low figure when compared with +150% growth of the last 15 years in UK, France and Spain). Morgan Stanley analysts already see signs of recovery in the German residential sector, so the stocks exposed to it may be attractive. Moreover, housing prices in the UK have fallen significantly more than expected: 40% in August from 48% in July, instead of the 47% expected fall. It’s the lowest level of the past 12 months. According to Bankinter, this is a good sign “because it dissipates the fear of a possible housing bubble and reduces the BoE arguments to raise its main interest rate in advance.”