Peter Lundgreen via Caixin | On October 14, the German government lowered its GDP growth forecast for this year from 1.8 percent to 1.7 percent. Despite this, the economic minister, Sigmar Gabriel, expressed his expectation of higher economic growth next year.

A majority of financial market participants share Gabriel’s trust in higher German growth next year, but the reality is that the headwinds for the country’s economy are strengthening. This is critical for China because Germany is one of its top export destinations.

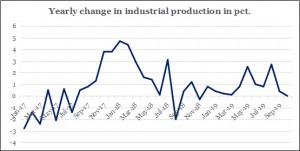

As the graphic shows, the annual growth in German industrial production has dropped to zero percent. The numbers have been below the expectations of economists for months and are far from supporting the desired growth rates, though it’s fair to mention that the primary cause for the drop is lower energy production. Factory orders actually increased in October for the first time in four months, but they remain below market expectations entering 2016. This is the opposite of what is needed to meet the forecast for higher growth next year. In addition, other parts of the German economy face rising risks.

Throughout the year private consumption has been a key contributor to economic growth. This is an unusual situation for Germany, which is known for relying on export-driven growth. As the Bundesbank, the central bank, reckons in its latest monthly economic report on December 4 domestic demand is still propping up the economy’s momentum. Private consumption remains at a decent level, but since the large increases in the early part of the year, a change has occurred. Back then, above-average wage increases and the introduction of the minimum wage gave a boost to private consumption that was also supported by lower energy prices. Many economists believe that the boost from private consumption will continue next year. Since consumer confidence peaked in June it has declined for six straight months. There are several reasons for this. One example of a concern on the part of consumers is value added to the private households’ total wealth. During the second quarter, wealth accumulation grew at 0.1 percent, the lowest level in 25 years. This was due to low interest rates and the weak stock market. Another example is the latest consumer confidence survey revealed that uncertainty about the job market is the biggest concern of respondents, a development that comes as a surprise.

Global growth will continue to face pressure next year, which is less-than-encouraging news for an export-driven economy like Germany’s. My assessment is that business investments in Germany will remain at a low level in 2016, just as they were this year. The impetus for GDP growth in Germany will continue to come from new construction and consumer spending. With a short-term interest rate remaining around zero percent, one can imagine it is possible that the construction sector still will keep up the pace for some time.

Upbeat economists argue that loose monetary policy combined with a weak euro will support growth in the eurozone, including in Germany, in 2016. Furthermore, the many refugees coming to the country will lead to higher government spending. This will probably add 0.2 percentage points to GDP growth next year. These are fair arguments, but they not extraordinary strong, and other forces are working against higher growth, particularly on Germany’s export markets.

German exporters are feeling the pain from the slowdown in business investments in many emerging market countries, as commodity prices have tumbled. Private consumption is still in fairly good shape around the globe, including in a number of emerging markets, but this not helping German exporters in the traditional way because consumers are not buying German cars. Instead, consumers are spending money on all sorts of services plus other smart consumption, such as online shopping and diginomics, i.e., downloading music via a service instead of buying a CD.

Should Germany’s GDP growth rate next year move toward 1.3 percent like I argue, it will be far short of the current general expectations of around 1.8 percent. The country will obviously survive very well, but this would have a negative effect on private households’ desire to consume more.

Moreover, companies exporting to Germany, especially suppliers to industry, will feel a certain reluctance. In the financial markets, particularly in the stock market, the risk of lower growth is not considered as being very likely either. This is one of the many reasons I expect higher volatility in financial markets next year.

In this context, it should be remembered that Germany’s GDP growth is the cornerstone of the total expansion in the eurozone. The wildest expectation for growth in the eurozone next year that I have seen comes from the European Commission. Its forecast is 2.1 percent against a GDP growth rate this year of 1.5 percent. The 2.1 percent expectation is absolutely unrealistic and there is certainly no room for lower German economic growth in this expectation.

In early 2015, I heard several major asset managers argue that it was the European stock markets’ turn to harvest gains. A similar statement came from some of the same fund managers before the bourses nosedived in August. I expect that we will see a similar situation at the start of next year. Just as in early 2015, the hope for growth and market gains in 2016 is based on expectations of higher GDP growth in Germany and the eurozone – but my main scenario is less expansion than expected.