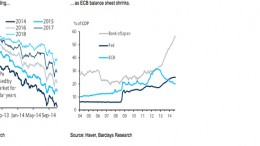

Eurozone faces an interest rates scenario highly dependent on ECB’s monetary policy

MADRID | The Corner | Risks for the Eurozone have significantly intensified in the last six months. According to experts at Afi, the reduction of the risk premium and more benign monetary conditions are not enough to boost the economic activity. The Euro depreciation, although stronger than the Dollar, was not as intense as that of other currencies, which suggests a moderate growth scenario for the export of the region. In such context, what is likely to happen with the interest rates in the next six months?