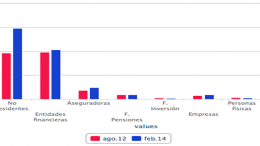

Spanish banks mitigate reliance on ECB

MADRID | By Fernando G. Urbaneja | In the midst of the financial turmoil (2012), the ECB facilitated liquidity to avoid the collapse of the European banks when the inter banking market was dried up and nobody lent money. The central bank had to act as “last resort banker” and maintain the system as well as guarantee liquidity. Those credit lines are amortized once their function has been accomplished. Now, they are preparing other measures to stimulate growth and avoid other threats such as deflation or stagnation.