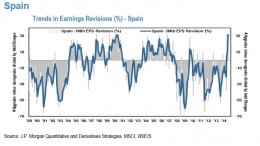

Spanish 3-month EPS hits new all-time high

MADRID | The Corner | The pace of Global net EPS revisions has declined in August to -6.9% from -0.6% in July, although it is more significant the 3-month net earnings revisions that has improved from -7.9% to -7.0%, according to Hugo Anaya in his comment for JP Morgan.