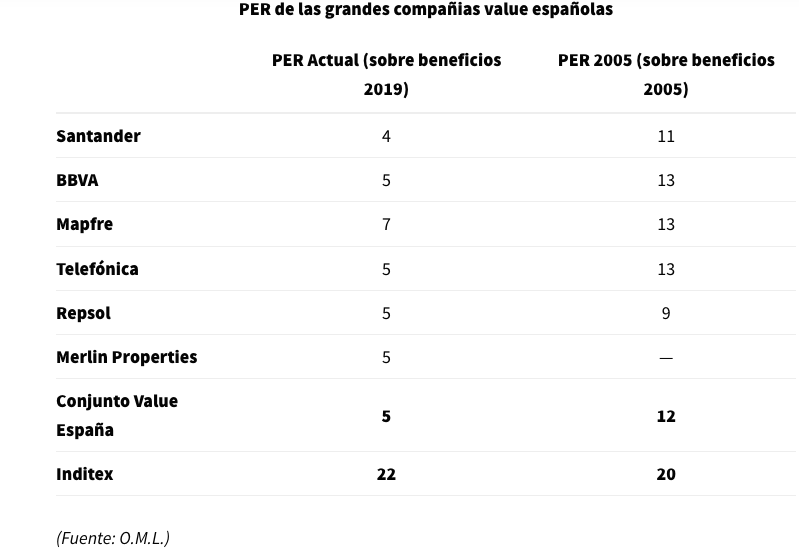

Ofelia Marín- Lozano | For some sectors there has not been a stock market crisis. However, others – banks, telecoms, oil,… – have in nine months gone from trading at 19x PER to trading at less than 5x. If everything returns to ‘normal,’ this does not seem sustainable.

The stock market crisis generated by the pandemic has notably accentuated a trend that we have been observing for years: the growing disparity in valuations – measured by the most commonly used indicators (PER, Price/Book, dividend yield, EV/EBITDA…) – between companies classified as “value” and “growth” companies.

The banks, which were trading at multiples of 7 times last year’s profit are now trading at only 4 times profit. Last year was objectively one of low, negative rates, in a long-term perspective, which only allowed the lenders to obtain ROEs of 8%, as opposed to the 10%-12% they would obtain with rates above zero.

Telecoms are trading at only 3-4 times EV/EBITDA, as opposed to the 5-6 times that any venture capital firm is willing to pay for companies with predictable flows. This means that, in multiples over a normalised profit, they have gone from being priced, in only 9 months since the beginning of the year, from just under 10 times PER to less than 5 times PER. All with multiples calculated on a normal year’s profit, the average of the last 5-10 years, not that of 2020 which could be anything…

Something similar happens with oil firms. And in the case of real estate companies, despite their 40%-70% falls in the stock market, the prices of real assets in the market have practically not fallen. (Or if they have, by 10%-15%, they would justify at most, taking into account the leverage effect, a fall of 20%-30% in the value of the capital).

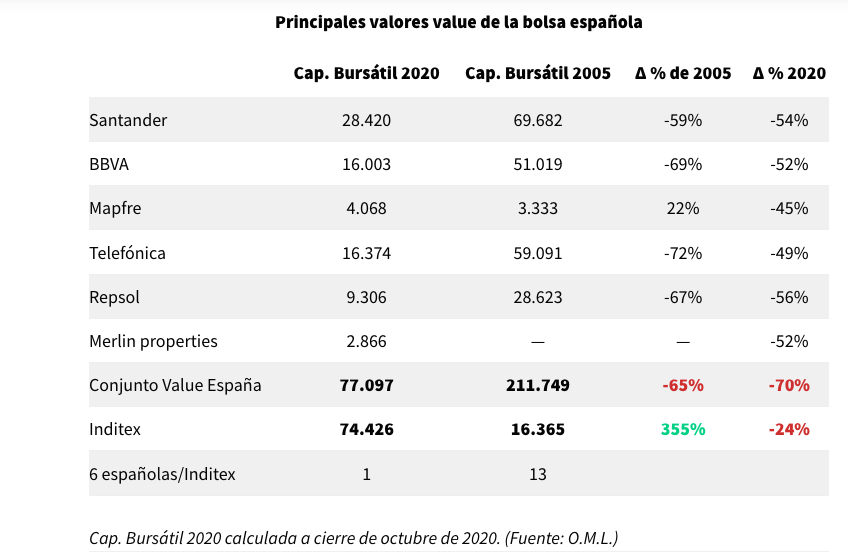

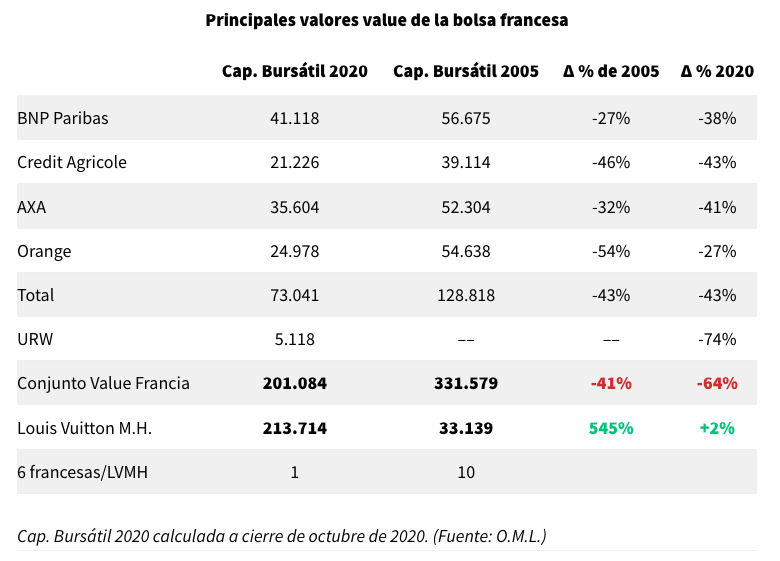

As an example, let’s make two comparisons, referring to some of the main Spanish stocks.

In Spain, for the price of the largest retailer (Inditex), we have the two largest banks (Santander and BBVA), the largest insurance company (Mapfre), the largest oil company (Repsol), the largest ‘teleco’ (Telefónica) and the largest real estate company (Merlin) in the country.

And in France as well. For the price of the biggest retailer (LVMH), you have the two biggest banks (BNP and Crédit Agricole), the biggest insurance company (Axa), the biggest oil company (Total), the biggest ‘teleco’ (Orange) and the biggest real estate company (Unibail) in the country.

So in other words, if Mr. Ortega or Mr. Arnault wanted to change their 50% in Inditex or LVMH tomorrow for a more diversified portfolio, they could immediately become absolute majority shareholders in those firms which control, at the same time, the absolute majority of the banking, insurance, oil and communications customers in Spain and France. And they would also get, as a gift, tens of billions of dollars in real estate assets.

Only a few years ago, the stock market value of Total or Orange – individually considered – was higher than that of LVMH. And the stock market value of Telefónica or Santander also clearly exceeded that of Inditex.

A fall concentrated in 2020

In the last 14 years, since 2005 (to take a normalised starting point, prior to the financial crisis), Inditex’s market capitalisation has seen a revaluation 355%, and that of LVMH 545%. Meanwhile, the average of the 6 great traditional stocks in the Spanish and French markets, taken as a reference, saw their market value fall by 65% and 41% respectively. The stock market decline of the French and Spanish telecoms operators, banks, insurance companies, oil, and real estate firms, has been concentrated in the year 2020 (-70% in the Spanish stock market, -64% in the French one). In 2020 both Inditex (with a limited drop of 24%) and, above all, LVMH (which is trading at 2% above its 2019 closing levels) have held up much better.

The main one, and the most evident reason, is that ‘growth companies’ earnings have honoured their label and grown very notably. Inditex’s profits have increased by 329% over the last 14 years, and LVMH’s by 398%. Inditex and LVMH earn between 4 and 5 times more than in 2005. Meanwhile, ‘value companies’ have seen their profits remain stagnant for 14 years (in fact, they have fallen by an average of 9% in Spain and 7% in France).

If 14 years ago the 6 big Spanish or French “value” companies earned 22 times more than Inditex or LVMH, respectively, now they “just” earn 4 or 5 times more.

In 2015, the market cap of the six “value” Spanish stocks was 13 times higher than that of Inditex. Meanwhile, the market cap of the six “value” French stocks was 10 times greater than that of LVMH. Today it is the same. Half of the differential increase (4-5 times) in stock market price would be justified by the greater growth in profits. But the rest comes from a clear shift away from the multiples the market is willing to pay for the profits of one and the other.

At the same time, there has been a moderate expansion of the most commonly used multiple, the PER, both in Inditex (from 20x in 2005 to 22x in 2019), and in LVMH (from 23x to 30x). But what has really made the difference is the contraction of multiples in the 6 stocks in each country (from 12x in 2005 to 5x in 2019 in the Spanish, and from 11x in 2004 to 7x in 2019 in the French).