Despite a constant “wall of worry” Europe is delivering on growth

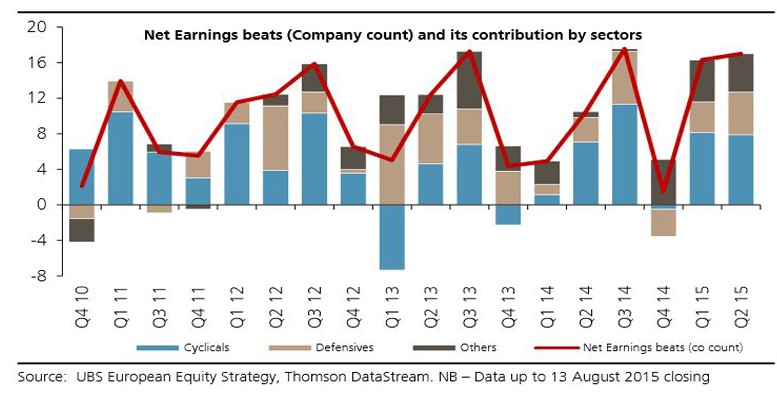

Macroeconomic concerns continue to be a drag on European stock markets. Greece came first, now China. All the while, however, European corporates are “delivering the goods”. Based on the results so far, Q2 2015 is slightly stronger than Q1 and one of the best earnings seasons in 5 years. Earnings beats are running c. 17% ahead of earnings misses on the back of better European domestic demand, FX tail winds and strong operational leverage.

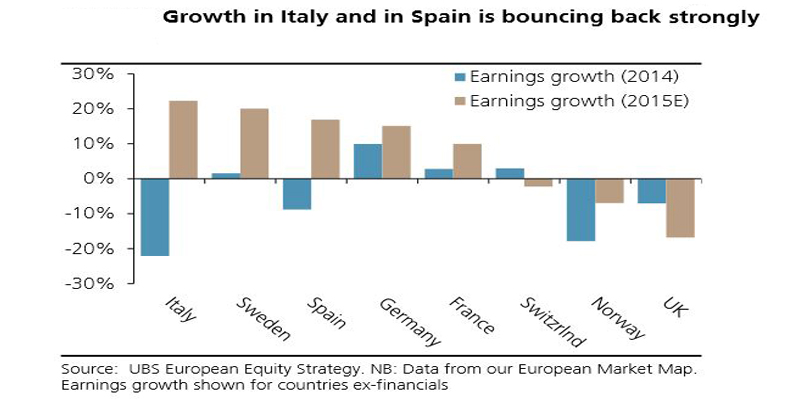

Eurozone drives the recovery–set for 25% EPS growth

Our Market Map data points to c. 25% EPS growth for Eurozone corporates in 2015 (Consensus points to 13.2%). Even sales and EBITDA are set to grow in the EZ for the first time in 3 years. Countries such as Italy and Spain are the main growth drivers. Italy moves from the most negative EPS growth in Europe in 2014 to the most positive in 2015 and trends are similar in Spain. By contrast, non-EZ countries such as UK, Switzerland, Norway show negative growth in 2015 driven by commodities and FX.

Leadership change-cyclicals lead while defensives and commodity sector lag

In many aspects this is a story of change in market leadership. Financials, now lead the earnings growth while Health Care appears challenged. Italy and Spain are delivering some of the strongest growth while Switzerland is falling behind. All key drivers of growth are cyclical sectors. After Financials, Cons Discretionary, Tech and Industrials offer the strongest growth. At the other end Staples, Health Care, Materials and Energy display the weakest growth. In many ways, this is the reverse of the situation we had grown accustomed to in Europe over the past few years.

Banks and IBs are the key drivers of profit recovery in Europe

Banks are expected to deliver the largest portion of the profit recovery in Europe, as well as being key to the economic recovery (through the credit cycle). The results for the Banks in Q2 are stronger than the market as a whole with earnings beats running c.20% ahead of misses. And looking at key drivers of earnings growth for the Banks such as loan demand we expect the sectors to continue to play a strong part in the European profit recovery.