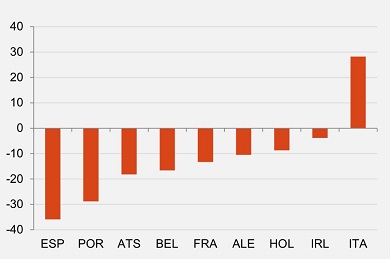

We all have been here before, but that doesn’t mean governments of the southern eurozone countries shouldn’t still keep an eye on sovereign bond yields. Right now, it is bad news for Italy, whose 10-year debt paper has seen investor distrust increase after the results of the national elections were known. Interest rates have gone up by almost 30 basis points, while for most of Italy’s neighbours the opposite is so far true–some 40 bp in the case of Spain.

Contagion has been bucked, then, in spite of the instability markets forecast over Italian politics and the severe difficulties ahead to form a cabinet with enough support to carry out the reform agenda.

Analysts in Madrid also blame the volume of Italian debt on sale this week, up to €15 billion. Spain and Ireland offered smaller figures, with better reception: Ireland, which had not approached markets since late in 2010, sold €5 billion with a demand of €12 billion, according to Afi Spain.

Portugal, by the way, has joined Ireland, too, in auctioning bonds with maturities of more than two years, which has triggered rumours about the possibility that the European Central Bank could purchase short-term debt from both countries to provide more liquidity into their economies. In Rome, they must be thinking that it would be a good idea to show investors that the euro has a central bank willing to act, and not just talk the talk.

Be the first to comment on "Thursday’s chart: Quo Vadis, Italian yield?"