European Views | With Europe witnessing a boom in technological innovation, it should be no surprise that legendary Silicon Valley venture capital (VC) firm Sequoia is finally opening a new office in London, its first in Europe. But the firm is merely the latest addition to a growing number of American VCs that are flocking across the Atlantic to expand their portfolios beyond their traditional, California-focused investments.

As American start-ups become ever more expensive thanks to sky-rocketing valuations, West Coast investors are increasingly looking at burgeoning European start-ups as an attractive alternative to Silicon Valley. European tech startups consequently saw a 40 percent surge in VC funding in 2019, accounting for $34 billion, leaving American and Asian ones in their trails.

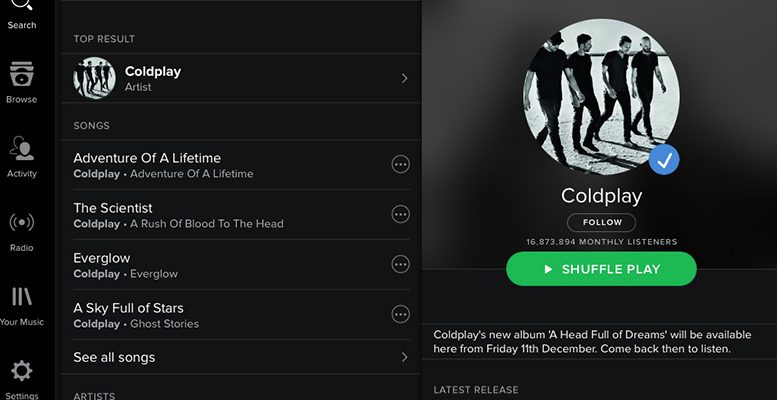

Europe currently boasts 99 unicorn companies, compared to only 22 such companies in 2012. Among them are apps like Swedish startup Spotify or Amsterdam’s payments app Aden, the former worth over $26 billion. This veritable golden-age of European tech innovation and seed funding might as well compete with Silicon Valley in a few years’ time—especially given that these startups represent genuine innovations while Silicon Valley is showing signs of growing stale since at least 2018.

The most important ingredient of their recipe for success is their ability to bring something new to the saturated app market – an ability to cater to the unique demands of consumers and listening to what people want, namely simplifying, securing and personalising online activities.

Reading the Zeitgeist: Deliveroo, Yubo, Lydia

Some of the big apps drawing huge investments in VC rounds are spread across a range of services and include the likes of British food-delivery app Deliveroo, as well as French apps Yubo and Lydia. While each of them caters to different consumer needs, what they all have in common is service which is tailored to the changing tastes and preferences of Millennials and the Gen Z generation.

Since its founding in 2013, Deliveroo has become a household name with more than 6 million users, and has helped the U.K. tech sector to generate more than £10 billion in 2019. The app uses an algorithm called Frank, which not only maximizes the earnings of the restaurant and the deliverer, but also reduces customers’ waiting time in matching food orders with restaurants.

This stunning success has seen high rewards: with a rumoured valuation of $4 billion, the food-delivery app netted around $575 million in 2019 from American investors like Amazon and Greenoaks Capital Management.

Another app that has succeeded in leaving its mark, this time in the highly-contested social media sector, is France’s Yubo. Boasting 20 million Gen Z users, Yubo wants them to develop organic connections and relationships. It thus contrasts with Facebook and Instagram, where the numbers of friends and likes run the show, and interaction can seem more stilted than personal.

Yubo aims to address the growing rates of loneliness and depression amongst teenagers, and was designed specifically for this age group in mind. Its unique selling point is its commitment to protecting the privacy of its young users, providing them with a safe platform to connect with one another using bespoke safety controls, including custom AI-based algorithms. The software automatically detects any violations of community standards and intervenes in real-time, thereby aiming to educate its users to adopt healthy online practices, rather than punishing them.

Not surprisingly, Yubo managed to rake in more than €11.2 million in funding in 2019 from Iris Capital, Idinvest Partners and Village Global, in what is a growing indication that investors believe the app is doing something right.

Still, Yubo is not the only French startup attracting big money. For any person living in France, the mobile-payments platform Lydia has become indispensable to money transactions, attracting 3 million users on a daily basis. Going beyond the basic services of a mobile-payments app, Lydia also has a “market” feature that allows customers to borrow funds of up to €1000 in a matter of seconds.

This year, the Paris-based outfit raised capital worth $45 million in a funding round led by Tencent, a Chinese multinational conglomerate. The growing popularity of the app amongst the target population of under-30s who want transactions to be card and cash-free, coupled with Lydia’s future plans of transforming into a meta-banking app, are clearly making this platform an appealing investment destination.

The way forward

These apps are but a snapshot of what’s moving the European tech market, and what could soon give Silicon Valley a run for its money. After all, the technological innovation scene in Europe is booming not just because of its high profit investment ratio but because its products take cognizance of the evolving needs and preferences of the consumers.

Modern, tech savvy people no longer share the same values or preferences as the older generations, all of which are facets that are being reflected in the latest app developments. For example, the appeal of food delivery apps derives from the fact that Millennials work longer and more irregular hours than any previous generation, making the preparation of food not always possible, or even desirable.

Similar dynamics may be at work when it comes to banking, with Millennials and Gen Z unwilling and unable to deal with long queues in banks or pay bank charges at a time when it’s clear that their generations will earn less than their parents or grand-parents. The trend will likely exacerbate with Gen Z, making decentralized banking via apps a serious rival to the established banking system.

The abundance of innovation on the continent and increasing capital to fund it signals the dawn of a new era, where Europe is rising as a veritable tech hub. European founders need no longer woo Silicon Valley to boost their success – now, investors are coming to them.