Wiliam Chislett | Membership of the EU since 1986 and of the euro zone since 1999, as a founder member, have transformed Spain’s economy and turned it from one of Western Europe’s most protected and least competitive into one of its most dynamic. In the process, the economic structure has changed significantly: agriculture, for example, generated 3% of GDP in 2017 and employed 4% of the workforce, down from 9% and 20%, respectively, in 1978, meaning that today the sector is much more productive.

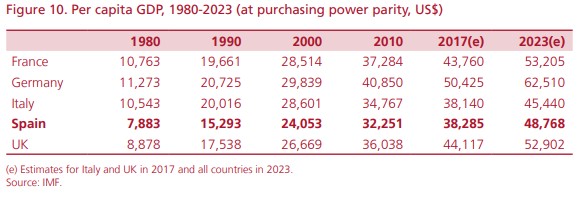

Spain has become far wealthier: per capita GDP at purchasing power parity increased from close to US$8,000 in 1978 to more than US$38,285 in 2017, a tad above Italy, according to the IMF (see Figure 10). Eurostat, the statistical office of the European Commission, using a different methodology, put Spain’s per capita GDP in 2017 at slightly below Italy’s (see Figure 1).

Getting the economy into shape to qualify for EU membership (negotiations began in earnest in 1982) was an arduous and socially painful task that largely fell to the first Socialist government of Felipe González. As a major importer of oil, the energy crisis sparked by price increases in 1973 and 1979 hit Spain hard. Inflation accelerated to 18% per annum in that period. The country was very slow to react, in part because the crisis coincided with the end of the Franco dictatorship in 1975 and the transition to democracy. Consumption of oil continued to grow as if nothing had happened: of the 10 leading Western industrial nations, Spain was the only one in which oil consumption increased.

The large and inefficient state-run industries such as shipbuilding (the world’s third largest in 1974) and steel (the 13th biggest), were massively slimmed down. The public sector was overburdened: in 1976 the Instituto Nacional de Industria (INI) had a stake in 747 most loss-making companies and a controlling interest in 379 others. The big profitable state companies regarded as strategic, such as Telefónica (telecoms), Repsol (oil and gas) and Endesa (electricity), were privatised in order to prepare them for the onslaught of competition arising from EU membership. Various companies of the sprawling National Institute of Industry (INI) were also privatised, most notably Seat, the loss-making car manufacturer, which was sold to Germany’s Volkswagen in order to guarantee its survival. The peseta was devalued. Of the 110 banks of all shapes and sizes, 58 of them suffered problems of one type or another between 1977 and 1985.

EU and euro zone membership have been hugely beneficial. More than 30 years after joining the EU, Spain was still a net recipient of EU funds. Between 1986 and 2016, the country received €95 billion more than what it contributed (excluding co-funding of EU projects). In the 1990s, net income from the EU represented 1% or more of GDP. The funds have played a significant role in improving the country’s infrastructure. The country’s roads, train services (the high-speed train network is the longest in Europe and the second in the world) and other infrastructure such as the fibre-optic network for high-speed data transmission (it covers three-quarters of the population) are world class. Spain’s infrastructure ranked 13th out of 137 countries in World Economic Forum’s competitiveness index. But it has come at an excessive cost. Spain wasted more than €81 billion on ‘unnecessary, abandoned, under used or poorly planned infrastructure’ between 1995 and 2016, according to a damning report published by the Association of Spanish Geographers and written by experts from nine universities. One-third of this amount (€26.2 billion) was squandered on the high-speed rail network. There were ‘too many multi-million-euro train stations, closed lines, stretches that were dropped halfway through construction, unnecessary lines, and cost overruns’, the report stated. ‘It was done without a proper cost/benefit analysis, and often on the basis of estimates of future users or earnings supported by a scenario of economic euphoria that was as evident as it was fleeting’. Valencia’s City of Arts and Sciences ended up costing more than €1.3 billion, nearly four times the original price tag, and several white elephant (‘ghost’) airports were built, notably at Castellón and Ciudad Real. The latter, opened in 2008, has the longest runway in Spain and was built to handle 2.5 million passengers a year. It was closed in 2012 and sold in 2016 for €56.2 million, a fraction of the original cost of around €1 billion.

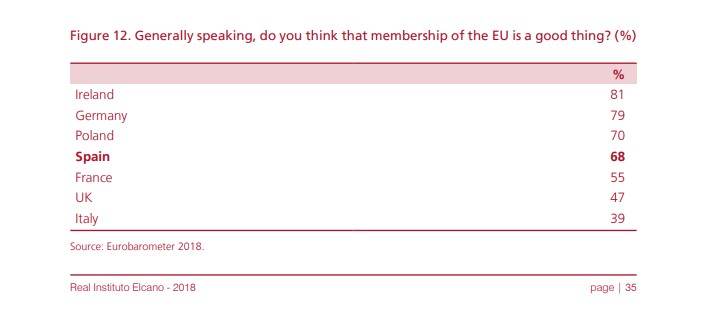

Not surprisingly, Spain is among the most pro-EU countries (see Figure 2). Integration in Europe has been part and parcel of Spain’s modernisation. As well as providing funds to develop infrastructure, EU and euro zone membership has made macroeconomic policy more disciplined, lured foreign direct investment, improved the financial conditions (a stable currency and low interest rates) for Spanish companies to make acquisitions abroad and facilitated export growth.

The economy dipped in 2008 when a massive property bubble burst (the number of housing starts in 2006 was more than Germany, France and the UK combined), triggering, along with the global financial crisis sparked by the collapse of Lehman Brothers, a Great Recession (Spain’s economic output shrank 9.2% between 2008 and 2013). Macroeconomic imbalances had greatly improved during the boom, apart from the current account deficit which hit 9.3% of GDP in 2007, but they now worsened. The unemployment rate skyrocketed from 8% to 27% in 2013, public debt almost trebled to 100% of GDP and the budget deficit soared from 2.2% of GDP to 10%. The non-performing loan (NPL) ratio for banking business in Spain surged from 0.7% of total lending in 2006 to a peak of 13.8% in 2013 (excluding the toxic loans placed in a specially created ‘bad bank’). Spain averted a full international bailout, as was the case for Greece, Ireland and Portugal, but several banks, most notably Bankia, the fourth-largest lender, had to be rescued by financial assistance from the European Stability Mechanism

It has been a long haul pulling Spain out of recession, aided by low interest rates and oil prices and not just by labour market and banking reforms and austerity measures. Not until 2017 did economic output recover its pre-crisis level. Unemployment was down to below 16% in 2018, but this was still double the euro zone average, public debt had stabilised, albeit at the very high level of 98% of GDP, the economy was growing at more than 2.7% for the fourth year running and the budget deficit looked to be on course to fall below the EU’s 3% limit for the first time in a decade. This would release Spain, the only EU country in this situation, from the European Commission’s excessive-deficit procedure. The deficit was lower, but there was still no primary fiscal surplus (before interest payments). The current account recorded its fifth consecutive surplus in 2017, an impressive turnaround and largely thanks to record exports of goods and buoyant tourism (82 million visitors) and a lower net debtor position relative to the rest of the world. Banks were also much healthier (the NPL ratio was down to around 6%). Unemployment remained the biggest problem.

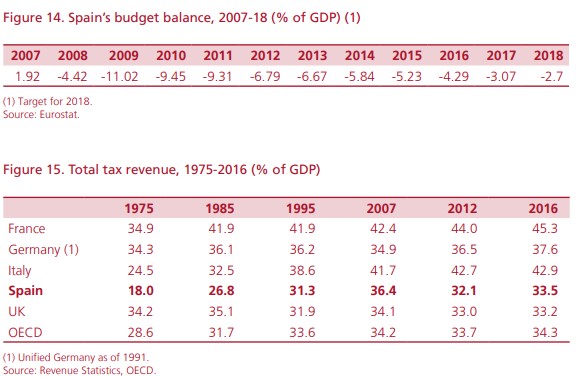

Cutting the budget deficit has been a long and winding road over the past decade (see Figure 3). Targets agreed with Brussels have either been missed or only met when revised upward. Tax revenue peaked at 36.4% of GDP in 2007 and has yet to recover that level (see Figure 4), while spending has taken a long time to control. Compared with more than 40 years ago when avoiding taxes was something of a national sport –total tax revenue stood at less than 20% of GDP in 1975 (personal income tax accounted for less than 1.5% of fiscal revenue) compared with an OECD average of 31%– Spain’s tax system today is relatively efficient and highly computerised. The number of people making personal income tax returns increased from 5.8 million in 1980 (15% of the population) to 19.5 million in 2017 (42%). Tax evasion was made an offence in 1977, a wealth tax was introduced in 1981 and VAT in 1986 upon Spain’s accession to the EEC. Nevertheless, tax fraud and evasion remained high (the Tax Agency recovered €14.8 billion in 2017).

Spain was ranked 36th in the IMD ranking in 2018, up from 45th in 2013, its lowest point (see Figure 19). The main weaknesses include the unemployment rate, the size of total general government debt, employee training and language skills.