The yellow metal fell 4% in the three months from the end of June — a decline that analysts at Wisdom Tree do not believe is justified by the 11 basis-point rise in bond yields and 0.4% gain in the US dollar over the period. Rather, gold’s poor performance seems to have been driven by a collapse in sentiment.

There has been talk in the market that some investors have lost faith in the precious metal as a safe haven, since it failed to appreciate during the recent emerging markets sell-off. But there’s a flaw in that argument: the fact that developed market equities remained strong during the period suggests that investors weren’t looking for a safe haven.

Ripe for a rally

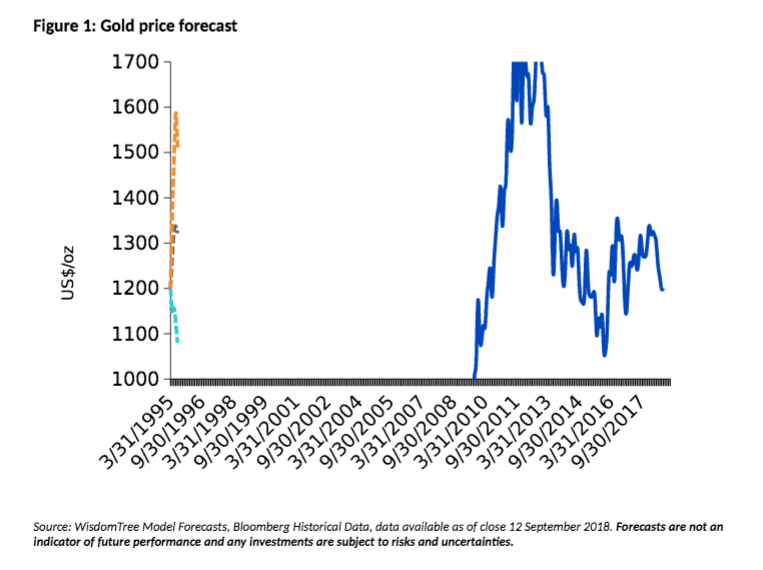

Today’s pessimism looks excessive and gold appears ripe for a short-covering rally. Wisdom Tree’s base case is for the metal to end this year close to US$1270/oz and reach US$1320/oz by Q3 2019, up from US$1200/oz at the time of writing (Figure 1).

Sentiment will be key

Looking ahead, analysts think sentiment will be key to gold’s next move. Rising interest rates usually drag on the gold price. But while the US Federal Reserve is expectedly to hike rates once more in 2018 and twice in 2019, these moves are widely expected and already largely priced into the US dollar and US bonds.

Easing inflationary pressures may also weigh on gold somewhat. US consumer price index (CPI) inflation reached 2.9% in July 2018, but several factors are working against an acceleration in price rises from here, including: the fact that gains in oil will soon fall out of the year-on-year comparisons; lower agricultural prices; and higher policy rates. Overall, experts at Wisdom Tree expect US inflation to decline to 2.4% by Q3 2018.

As for the US dollar, the risks are to the downside, which would be supportive of gold. While we don’t think that three Fed rate hikes will surprise the market, there is a risk that other central banks could tighten policy. Combined with growing indebtedness in the US — exacerbated by recent tax cuts — this would put downward pressure on the greenback.

But all that said, none of these factors is likely to move the dial much for gold. Which brings us back to sentiment as the likely driver of the metal’s price. So what could drive a change in sentiment?

Watching sentiment

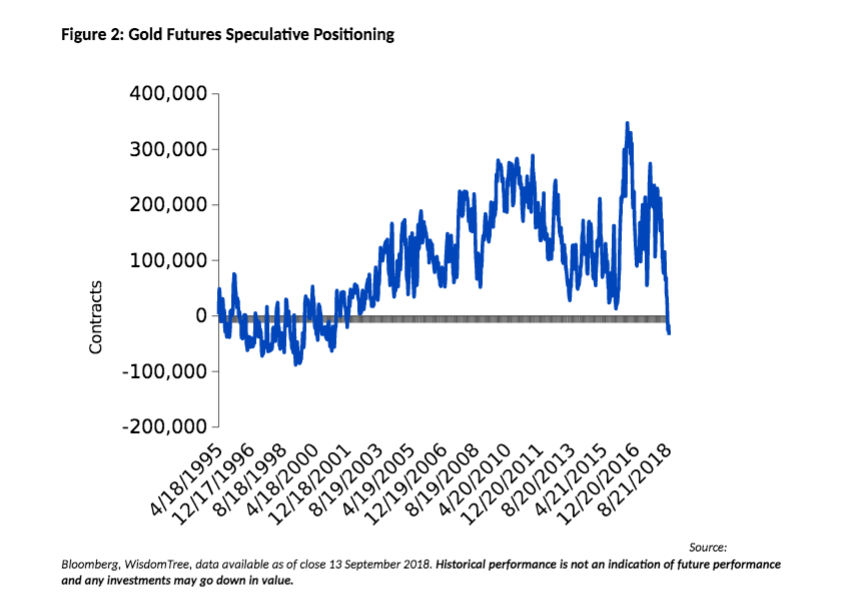

Analysts measure sentiment by looking at speculative positioning in the gold futures market, which is at its lowest level since 2001. Simply put, they think the current negative net speculative positioning is unusual ( Figure 2 ), particularly in light of the risks in the market (discussed below).

Consequently, even in a flat to mild price recovery, many short gold positions (i.e., investments based on the expectation that the metal’s price will fall) will be covered. This tends to exacerbate price gains and could set in motion a rally.

Several factors could spark a return of risk-off sentiment and remind investors of gold’s historical defensive qualities:

- Trade wars: protectionism in the US would not continue rising to damage global economic demand. But if tit-for-tat protectionist measures escalate, the market could be driven into a risk-off mindset.

- Brexit negotiations : With the March 2019 deadline looming for the UK’s departure from the EU, there are plenty of details to be ironed out. Failure to negotiate a trade agreement could be damaging for both the UK and EU.

- Financial tensions : Despite several bouts of equity market volatility this year, developed world equities have largely remained resilient. But there’s no guarantee they will be so sanguine in the next shock.

Conclusion

Various outcomes for gold remain possibl, but the firm’s base case is that speculative positioning in the futures market will be restored as short positions are covered, driving gold prices to about US$1320/oz by this time next year.