Intermoney | Aena (AENA) (Buy, Target Price €215/share) has announced its 2024 annual results and will hold a conference call today at 1pm.

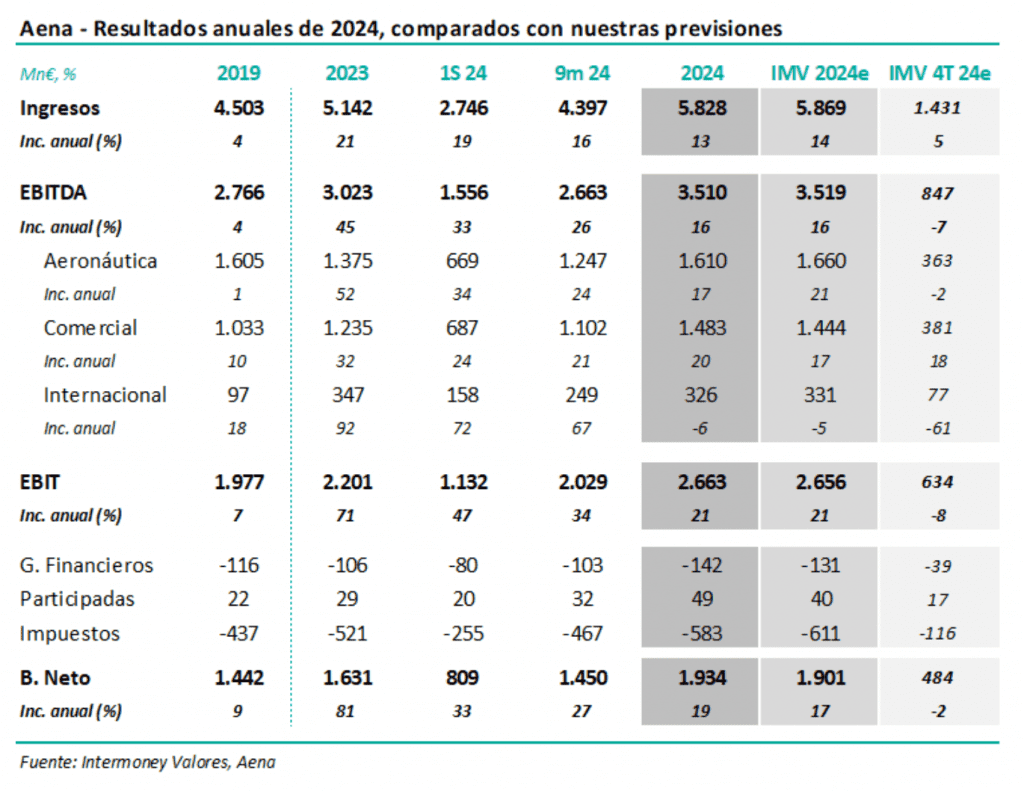

The main figures are shown in the following table. Based on last year’s traffic levels, which far exceeded pre-pandemic records (112% in Spain), Aena generated EBITDA of €3.51 billion in 2024 (up 16%), or 127% of the 2019 figure, quite in line with estimated IMV (€3.52 billion). In Q4 alone, EBITDA fell by 7% due to the non-repetition of a reversal in International. Net profit to December, €1,934m (€1,901 million estimated IMV), also exceeded the pre-pandemic level of €1,442 million in 2019.

We confirm our estimates, which we clearly raised (10% at EBITDA level) in the note of 15 July and did not change after Q3, and which imply an estimated 11% CAGR 23-26.

Aena has announced an estimated growth in traffic in Spain of 3.4% in 2025, almost identical to our forecast of 3.5%.

Aena’s revenues increased by 13% in 2024 to €5,828 million (€5,869 million estimated IMV), 129% of the 2019 figure. This was largely the result of:

– Strong year-on-year increase in traffic during the last stand-alone Q4 in Spain (up 8%), clearly exceeding pre-pandemic levels (+17%), which allowed aerospace industry activity to grow its turnover by 12% in 24, very slightly below estimated IMV (11% compared to 2019). Average revenue, due to regulation and mix, increased by 4% to €10.3, which confirmed a certain acceleration compared to previous quarters (€10.4 estimated IMV).

Good news also in the commercial aviation division, where revenue per passenger continued its excellent trend, reaching €5.75 in December, up 5% on 2023 and exceeding the €4.55 in 2019, leading to revenues of €1.780 billion in December, quite in line with the €1.768 billion estimated IMV.

EBITDA of €3,510 million in 2024 (€3,519 million estimated IMV), 127% pre-pandemic, with greater cost stability. Aena generated an EBITDA of €3.51 billion to December, representing 127% of the pre-pandemic figure, or 16% higher than last year’s figure, in line with our forecast of €3.16 billion. We highlight:

- The operating leverage of Aeronáutica usually works against it in Q4, unlike in Q3. A demanding comparison with 23 meant that operating costs fell by 2% compared to 2023 to €5.1/passenger (€5.0 estimated IMV), leading to a business EBITDA of €1.61 billion as of December (€1.66 billion estimated IMV), which was in balance with the pre-pandemic level.

- Good results again in the Commercial business, whose reported EBITDA figure of €1,483 million (€1,440m estimated IMV) was 44% higher than the pre-pandemic figure, a direct consequence of revenue growth. The margin rose by almost 370 bp compared to 2023 to over 83%. In International Markets, in Q4 23 a provision of €155 million was reversed, something that did not happen this time; on the other hand, the contribution of all the assets in Brazil since January caused EBITDA to fall by only 6% to €326 million (+70% proforma) compared to €331 million estimated IMV.

Net profit of €1,934 million (up 19%), somewhat above estimated IMV and also above pre-pandemic levels. Below the EBITDA there were no surprises, beyond some negative items for financial adjustments of around -€15 million, already present in September, and including financial items of -€142 million, leading Aena to a net profit of €1,934 million, higher than the €1,445 million pre-pandemic, and compared to €1,901 million estimated IMV.