Renta 4 | Enagás will present its 2024 results probably on Tuesday 18 February 2025 before the open, conference that same day at 8am. P.O. €19.21, overweight.

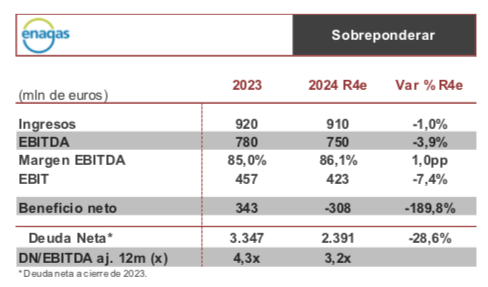

Slight cut expected in revenues, as a result of lower estimated regulated revenues that will not be offset by the higher contribution from Musel and COPEX. Ebitda in turn will be affected by the lower contribution from investees despite the partial compensation of the higher stake in TAP to the deconsolidation of Tallgrass, although we expect it to exceed the guidance of €730-740 million. Recurrent net profit is expected to be €296 million (exceeding the target range of €270-280 million), although the losses from the sale of Tallgrass for slightly more than €360 million (already recorded in 9M) and from the GSP arbitration settlement, which we estimate will generate a loss of €240 million (€320 million partially offset by the expected positive tax effect of €80 million), should be taken into account.

Regarding the evolution of net debt, we expect that the $1,100 million received by Tallgrass (already recorded in 9M), together with an expected improvement in operating cash flow, will allow us to reduce leverage significantly and bring net debt in line with the guidance of €2,400 million.

At the earnings conference we are expected to see an update on the group’s strategy, providing visibility on the group’s objectives for the coming year. No changes are expected in the dividend policy to 2026.