The average wealth of households has increased by 80.9% over twenty years (in real terms), spanning from 2002 to 2022, driven by the revaluation of real estate assets and, more recently, by the growth of financial assets. However, this progress has been concentrated in the highest percentiles: the richest 1% today accumulates over 21% of the total wealth, compared to 13% in 2002. The Gini index for household wealth has risen from 0.57 to 0.69, confirming a structural increase in wealth inequality.

Consequently, over the last two decades, the wealth of Spanish households has grown significantly, but in a highly uneven manner. While total assets have almost doubled since 2002, the concentration of wealth in the richest households and the generational gap in asset accumulation have steadily widened. This is one of the conclusions of a study conducted for FEDEA (Foundation for Applied Economics Studies) by José Ignacio Conde-Ruiz and Francisco García Rodríguez on the “Evolution of Family Wealth in Spain (2002-2022). Levels, Composition, and Generational Fracture.”

The study also documents a deep generational fracture: cohorts born between 1956 and 1975 (end of the baby boom and early Generation X) have consolidated high levels of wealth thanks to a context of stable employment, accessible credit, and strong real estate appreciation. In contrast, Millennials (born after 1986) accumulate less wealth than previous generations at the same age, face greater barriers to housing access, and have a homeownership rate of less than 40%. The average wealth gap between those under 35 and those over 75 has widened from €50,000 in 2002 to more than €360,000 in 2022.

The authors note that the composition of wealth continues to be dominated by real assets—which represent 80% of the total—but an incipient financial diversification is evident among the wealthiest households. Debt, mainly focused on primary residences, has decreased since the financial crisis, reflecting a pattern of greater prudence.

Conde-Ruiz and García-Rodríguez warn that this trend may have lasting consequences for intergenerational equity and wealth mobility. The limited capacity of young people to access housing or financial savings could reinforce a “hereditary wealth gap” that perpetuates long-term economic and social inequalities.

The report concludes that public policies must prioritize intergenerational wealth redistribution, affordable housing access, and the promotion of saving among young households, in order to guarantee a more balanced distribution of economic opportunities.

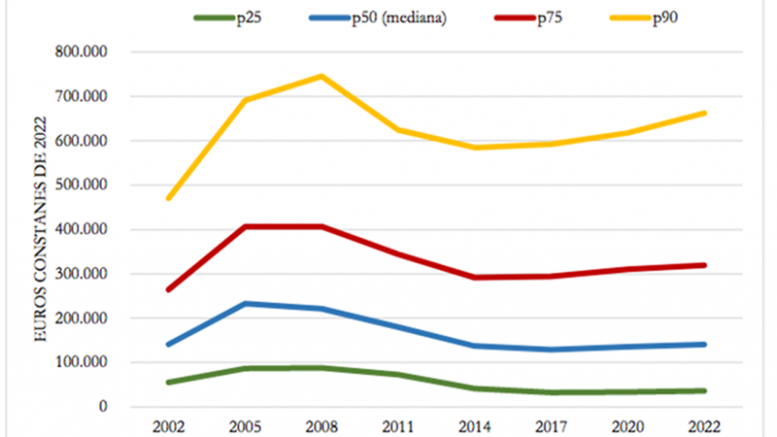

The table (“Evolution of net wealth across selected distribution percentiles”) illustrates the evolution of net wealth across different distribution percentiles between 2002 and 2022. The data reveals a sharp concentration of wealth in households at the top of the distribution: the 90th percentile shows a substantially higher wealth level than the rest, and its trajectory largely dictates the aggregated trend. Between 2002 and 2008, all percentiles experienced sustained wealth growth, reflecting the economic boom and the expansive real estate market cycle. However, the financial crisis that began in 2008 caused a significant contraction, especially in the 90th percentile, which demonstrates the loss of asset value among the wealthiest households. Following the low recorded in 2014, a progressive recovery is observed, although with a clearly uneven intensity: while the 90th percentile resumes an accelerated growth path, the lower percentiles—such as the 25th and the 50th (median)—show a much more contained evolution, with minor real variations throughout the period. This widening divergence culminates in 2022 with a gap broader than that observed in 2002, suggesting an increase in the concentration of wealth in the highest segments of the population.